Technological Advancements

Technological innovations play a pivotal role in shaping the Global Oilfield Casing Spools Market Industry. The introduction of advanced materials and manufacturing techniques enhances the performance and reliability of casing spools. For instance, the development of composite materials offers improved resistance to corrosion and pressure, which is crucial in harsh drilling environments. Furthermore, automation and digitalization in oilfield operations streamline processes, reducing costs and increasing efficiency. As these technologies continue to evolve, they are expected to drive market growth, with projections indicating a compound annual growth rate of 6.04% from 2025 to 2035, underscoring the importance of innovation in this sector.

Market Trends and Projections

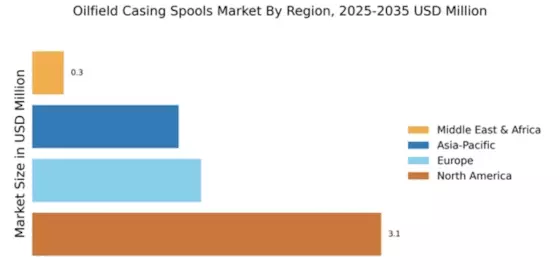

The Global Oilfield Casing Spools Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 7.28 USD Billion in 2024 and 13.9 USD Billion by 2035, the industry is on a promising trajectory. The anticipated compound annual growth rate of 6.04% from 2025 to 2035 indicates a robust expansion phase. This growth is driven by various factors, including rising energy demands, technological advancements, and increased investments in exploration activities. As the market evolves, it is essential for stakeholders to monitor these trends and adapt their strategies accordingly to capitalize on emerging opportunities.

Rising Demand for Oil and Gas

The Global Oilfield Casing Spools Market Industry is experiencing a surge in demand driven by the increasing need for oil and gas. As economies worldwide continue to develop, the consumption of energy resources rises, prompting exploration and production activities. This trend is particularly evident in regions such as North America and the Middle East, where significant investments are being made in oil extraction technologies. The market is projected to reach 7.28 USD Billion in 2024, reflecting the industry's robust growth trajectory. This demand is likely to sustain the need for advanced casing spools, which are essential for maintaining well integrity during drilling operations.

Regulatory Frameworks and Standards

The Global Oilfield Casing Spools Market Industry is significantly influenced by stringent regulatory frameworks and safety standards. Governments and regulatory bodies worldwide impose guidelines to ensure the safe and efficient operation of oil and gas extraction activities. Compliance with these regulations necessitates the use of high-quality casing spools that meet specific safety and performance criteria. For example, the American Petroleum Institute (API) sets standards that casing spools must adhere to, promoting safety and environmental protection. As regulations become more rigorous, the demand for compliant casing spools is expected to rise, further driving market growth and ensuring the integrity of oilfield operations.

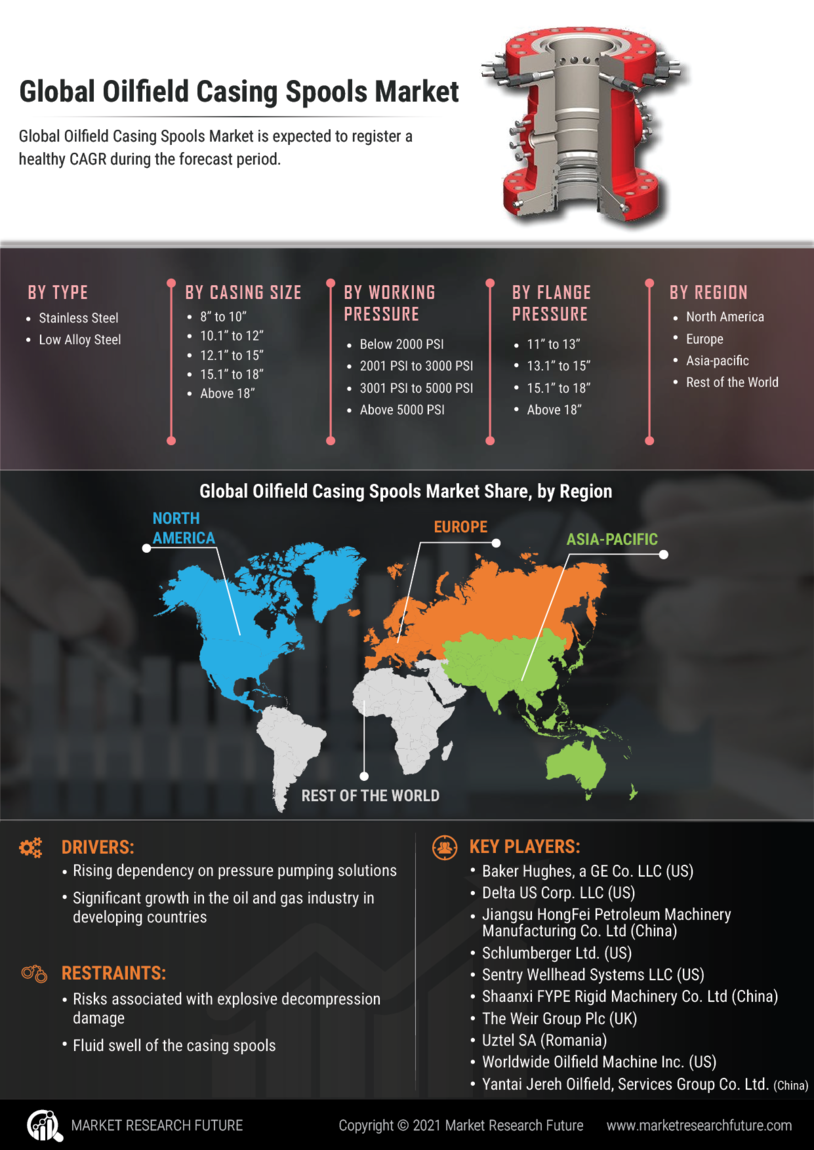

Market Dynamics and Competitive Landscape

The Global Oilfield Casing Spools Market Industry is characterized by dynamic market conditions and a competitive landscape. Key players are continually striving to enhance their product offerings and expand their market presence through strategic partnerships and mergers. This competitive environment fosters innovation, leading to the development of advanced casing spool designs that cater to diverse operational needs. Additionally, the entry of new players into the market intensifies competition, prompting existing companies to improve their service quality and product reliability. As the market evolves, these dynamics are likely to shape the future of the casing spools industry, influencing pricing strategies and customer preferences.

Increasing Investments in Exploration Activities

The Global Oilfield Casing Spools Market Industry benefits from the growing investments in exploration and production activities. As oil prices stabilize, companies are more inclined to invest in new drilling projects, particularly in untapped reserves. Regions such as Africa and South America are witnessing increased exploration efforts, leading to a higher demand for casing spools. This trend is expected to contribute to the market's expansion, with projections indicating a market value of 13.9 USD Billion by 2035. The influx of capital into exploration activities not only boosts the demand for casing spools but also encourages the development of innovative solutions to enhance drilling efficiency.