Slovenia Liquified Petroleum Gas Market Summary

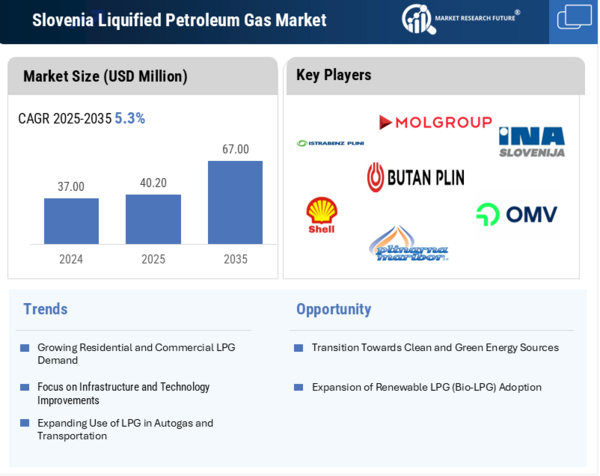

As per Market Research Future analysis, the Slovenia Liquified Petroleum Gas Market Application was valued at USD 37.00 Million in 2024. Slovenia Liquified Petroleum Gas industry is projected to grow from USD 40.20 Million in 2025 to USD 67.00 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.3% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Slovenia's Liquefied Petroleum Gas (LPG) market reflects a niche but dynamic segment of the country's energy sector:

- Slovenia's energy transition policies promoting renewables, reducing LPG's share in heating and transport. Per capita consumption has mirrored this downturn, though exports buoy the economic footprint.

- Slovenia's production relies on byproducts from oil refining, primarily at the Naftohim facility near Ljubljana, which processes imported crude into LPG alongside gasoline and diesel.

- Government monitoring via the Agency for Energy sets petroleum product prices, influencing LPG retail at stations like Petrol's network.

- Slovenia's leading energy firm, dominates LPG supply, distribution, and retail, offering it for residential, commercial, and Autogas use.

Market Size & Forecast

| 2024 Market Size | 37.00 (USD Million) |

| 2035 Market Size | 67.00 (USD Million) |

| CAGR (2025 - 2035) | 5.3% |

Major Players

Istrabenz Plini Group, Petrol Group, Butan Plin, Plinarna Maribor, INA Slovenija, GTG Plin, MOL Group, OMV, Shell plc, SHV Energy, Others.