Tracer Services for Oil Gas Well Intervention Market Summary

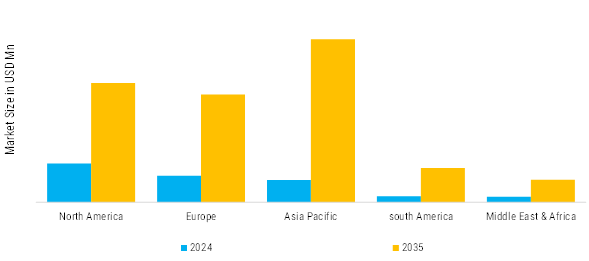

As per Market Research Future analysis, the Tracer Services Market for Oil & Gas Well Intervention Market was valued at USD 1.12 Billion in 2024. The market is projected to grow from USD 1.20 Billion in 2025 to USD 2.05 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.7% during the forecast period (2025–2035).

Key Market Trends & Highlights

The global tracer services market specifically for oil and gas well intervention is a niche segment within broader well intervention services, focusing on chemical or radioactive tracers to monitor fluid flow, well integrity, and production allocation in wells.

- Eco-friendly, biodegradable tracers replace radioactive ones to meet net-zero goals. Water-based and DNA-labeled tracers reduce environmental risks in sensitive areas like the North Sea, aligning with stricter EU and U.S. regulations Rising Influence of social media and Online Marketing.

- Digital tools dominate tracer applications, with AI and real-time data analytics enabling predictive flow monitoring. Platforms like SLB's systems integrate tracers with IoT for automated detection.

- Automated wireline deployments with embedded tracers reduce crew exposure and costs. ROV-integrated tracers inspect subsea wells, vital as offshore activity rises post-2025 investments.

- Tracer services in oil and gas well intervention use chemical, radioactive, or gas-based tracers to monitor fluid flow, well integrity, production allocation, and inter-well connectivity, especially in mature fields

Market Size & Forecast

| 2024 Market Size | 1.12 (USD Billion) |

| 2035 Market Size | 2.05 (USD Billion) |

| CAGR (2025 - 2035) | 5.7% |

Major Players

Tracerco, Resman, NCS, SGS SA, Renegade Wireline Services, Carbo Ceramics, Chemicals Tracers, Inc , ResMetrics Flu Technik