India HVACR Motors Market Summary

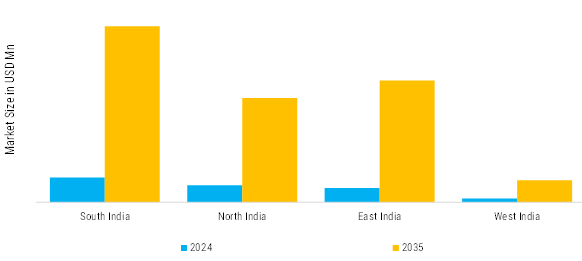

As per Market Research Future analysis, India HVACR Motors Market Size was estimated at 11.67 (USD Million) in 2024. India HVACR Motors Market Industry is expected to grow 45.42 USD Million) by 2035. The India HVACR Motors Market CAGR (growth rate) is expected to be around 16.16% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

India's HVACR Motors Market sector, which is expanding rapidly due to urbanization and demand for energy-efficient systems.

- Brushless DC (BLDC) and electronically commutated motors (ECMs) dominate due to superior efficiency over traditional induction motors. These motors reduce energy consumption by 30-50% in HVACR applications like fans and compressors.

- HVACR systems increasingly incorporate IoT-enabled motors with variable speed drives (VSDs) for real-time optimization. Sensors monitor load, temperature, and airflow, enabling predictive maintenance.

- The shift from high-GWP refrigerants like R-410A to low-GWP options (R-32, R-454B) under the Kigali Amendment requires motors compatible with varying compressor pressures. This drives demand for hermetic and semi-hermetic motors.

- Motors embed microcontrollers running edge AI for anomaly detection, reducing downtime by 40% without cloud dependence.

- Cold chain infrastructure under PM KUSUM and food processing initiatives drives hermetic motors for compressors. Trends include oil-free scroll compressors with integrated VFD motors for pharma and dairy sectors, emphasizing hygiene and low vibration.

Market Size & Forecast

| 2025 Market Size | 11.67 (USD Million) |

| 2035 Market Size | 45.42 (USD Million) |

| CAGR (2025 - 2035) | 16.16% |

Major Players

WEG, Havells, Marathon, LHP, Wolong, HEM, Hitachi, ABB, LG Electronics, Johnson Electric Holdings Limited