North America : Market Leader in Services

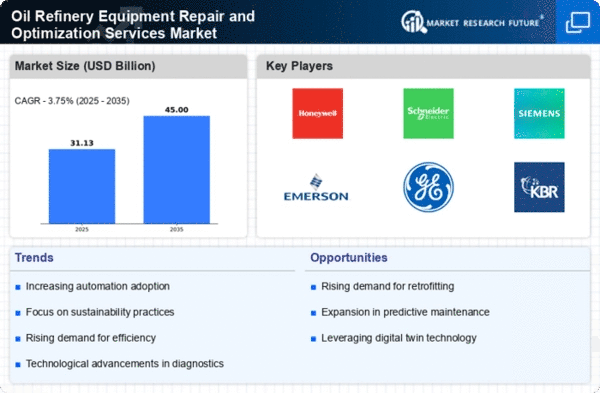

North America is poised to maintain its leadership in the Oil Refinery Equipment Repair and Optimization Services Market, holding a significant market share of 15.0 in 2024. The region's growth is driven by increasing demand for efficient refining processes, stringent environmental regulations, and the need for modernization of aging infrastructure. Regulatory catalysts, such as the Clean Air Act, further enhance the market's potential by promoting advanced technologies and sustainable practices. The competitive landscape in North America is robust, featuring key players like Honeywell, Schneider Electric, and Emerson Electric. The U.S. stands out as the leading country, supported by substantial investments in refining capacity and technological advancements. The presence of major corporations ensures a dynamic market environment, fostering innovation and service optimization across the sector.

Europe : Emerging Market Dynamics

Europe's Oil Refinery Equipment Repair and Optimization Services Market is projected to grow, with a market size of 8.0 in 2025. The region is experiencing a shift towards more sustainable refining practices, driven by regulatory frameworks such as the European Green Deal, which aims to reduce carbon emissions significantly. This regulatory push is fostering demand for advanced repair and optimization services that align with environmental goals, thus enhancing market growth. Leading countries in this region include Germany, France, and the UK, where major players like Siemens and TechnipFMC are actively involved. The competitive landscape is characterized by a mix of established firms and innovative startups, all striving to meet the evolving demands of the market. The focus on digitalization and efficiency in operations is expected to further propel the market forward, creating opportunities for service providers.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is emerging as a significant player in the Oil Refinery Equipment Repair and Optimization Services Market, with a market size of 5.0 in 2025. The growth is fueled by increasing energy demands, rapid industrialization, and government initiatives aimed at enhancing refining capabilities. Countries like China and India are investing heavily in modernizing their refineries, which is expected to drive demand for repair and optimization services in the coming years. China leads the region in refining capacity, supported by major players such as Emerson Electric and KBR. The competitive landscape is evolving, with both local and international firms vying for market share. The focus on efficiency and sustainability is becoming paramount, as regulatory bodies push for cleaner technologies and practices, creating a favorable environment for service providers in the region.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is witnessing gradual growth in the Oil Refinery Equipment Repair and Optimization Services Market, with a market size of 2.0 in 2025. The region's growth is primarily driven by its vast oil reserves and the need for efficient refining processes. Governments are increasingly focusing on enhancing refinery capabilities to meet both domestic and international demands, which is expected to boost the market for repair and optimization services. Leading countries in this region include Saudi Arabia and the UAE, where significant investments are being made in refining infrastructure. The competitive landscape features both local and international players, with companies like Fluor Corporation and Jacobs Engineering playing key roles. The emphasis on modernization and efficiency is critical, as the region seeks to optimize its refining operations and reduce operational costs.