North America : Market Leader in Catalyst Services

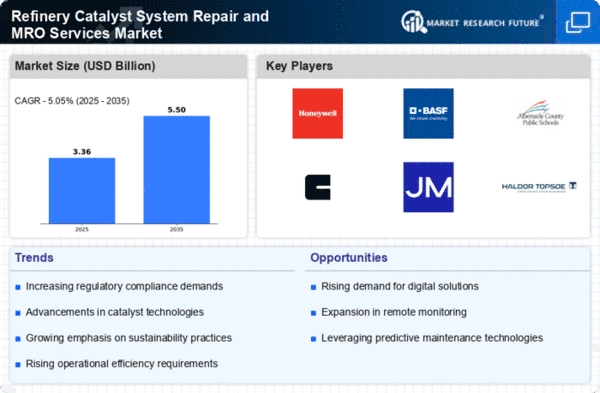

North America is poised to maintain its leadership in the Refinery Catalyst System Repair and MRO Services Market, holding a significant market share of $1.6B in 2025. The region's growth is driven by stringent environmental regulations and a shift towards more efficient refining processes. The demand for advanced catalyst technologies is increasing, supported by investments in refinery upgrades and maintenance services. The United States stands out as the primary market, with key players like Honeywell, Albemarle, and W.R. Grace leading the competitive landscape. These companies are focusing on innovation and sustainability to enhance their service offerings. The presence of established firms and a robust regulatory framework further solidify North America's position as a hub for catalyst repair and MRO services.

Europe : Emerging Market with Growth Potential

Europe's Refinery Catalyst System Repair and MRO Services Market is valued at $0.9B, reflecting a growing demand for efficient refining solutions. The region is experiencing a shift towards sustainable practices, driven by EU regulations aimed at reducing emissions and enhancing energy efficiency. This regulatory environment is fostering innovation and investment in catalyst technologies, positioning Europe as a key player in the global market. Leading countries such as Germany, France, and the UK are at the forefront of this growth, with major companies like BASF and Clariant actively participating in the market. The competitive landscape is characterized by a mix of established firms and emerging players, all striving to meet the evolving demands of the refining sector. The focus on sustainability and regulatory compliance is expected to drive further growth in the coming years.

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific region, with a market size of $0.7B, is witnessing rapid growth in the Refinery Catalyst System Repair and MRO Services Market. This growth is fueled by increasing energy demands and the expansion of refining capacities in countries like China and India. Regulatory initiatives aimed at improving air quality and reducing emissions are also driving the adoption of advanced catalyst technologies in the region. China is the leading country in this market, with significant investments in refinery upgrades and maintenance services. Key players such as Haldor Topsoe and Axens are actively involved in providing innovative solutions tailored to the region's needs. The competitive landscape is evolving, with both local and international firms vying for market share, indicating a dynamic and competitive environment.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region currently holds a minimal market size of $0.0B in the Refinery Catalyst System Repair and MRO Services Market. However, the region presents untapped opportunities due to its rich oil reserves and increasing investments in refining infrastructure. As countries in this region seek to enhance their refining capabilities, the demand for catalyst repair and MRO services is expected to grow. Leading countries such as Saudi Arabia and the UAE are focusing on modernizing their refineries, which will likely drive the need for advanced catalyst technologies. The competitive landscape is still developing, with potential for both local and international players to establish a presence. As regulatory frameworks evolve, the market is anticipated to gain momentum in the coming years.