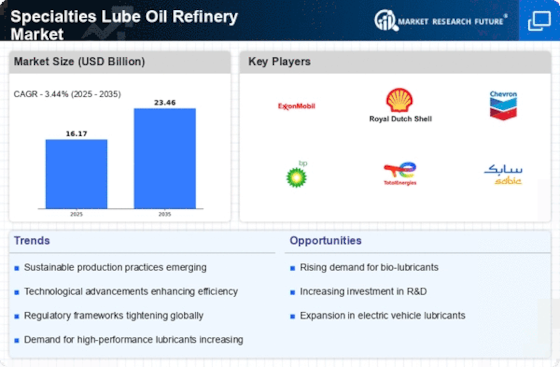

Increasing Focus on Energy Efficiency

The increasing focus on energy efficiency is a critical driver for the Specialties Lube Oil Refinery Market. Industries are under pressure to reduce energy consumption and operational costs, leading to a heightened demand for lubricants that enhance machinery efficiency. High-quality specialty lubricants can significantly lower friction and wear, resulting in improved energy efficiency and reduced maintenance costs. According to industry estimates, the use of advanced lubricants can lead to energy savings of up to 10% in industrial applications. This trend is prompting refineries to invest in research and development to create innovative lubricant formulations that meet these energy efficiency requirements. As industries strive for sustainability and cost-effectiveness, the demand for such specialized lubricants is expected to grow, driving the Specialties Lube Oil Refinery Market forward.

Rising Demand for High-Performance Lubricants

The increasing demand for high-performance lubricants is a pivotal driver for the Specialties Lube Oil Refinery Market. Industries such as automotive, aerospace, and manufacturing are increasingly seeking lubricants that enhance efficiency and reduce wear. This trend is underscored by the projected growth of the automotive sector, which is expected to reach a market size of approximately 3 trillion USD by 2025. As manufacturers strive for improved performance and sustainability, the need for specialized lubricants that meet stringent regulatory standards becomes paramount. Consequently, refineries are adapting their production processes to cater to this demand, thereby driving innovation and investment in the Specialties Lube Oil Refinery Market.

Technological Innovations in Refining Processes

Technological innovations in refining processes are reshaping the Specialties Lube Oil Refinery Market. Advanced refining technologies, such as hydrocracking and solvent extraction, are enabling refineries to produce higher-quality specialty lubricants with improved performance characteristics. These innovations are crucial as they allow for the extraction of specific components that enhance lubricant properties, such as viscosity and thermal stability. The adoption of these technologies is expected to increase production efficiency by up to 30%, thereby reducing operational costs. Furthermore, the integration of automation and data analytics in refining operations is streamlining processes, leading to better quality control and reduced waste. This technological evolution is likely to position refineries competitively in the market.

Growth of Electric Vehicles and Alternative Fuels

The growth of electric vehicles (EVs) and alternative fuels is emerging as a transformative driver for the Specialties Lube Oil Refinery Market. As the automotive landscape shifts towards electrification, the demand for specialized lubricants that cater to electric drivetrains is increasing. EVs require lubricants that can withstand higher temperatures and provide optimal performance under varying conditions. This shift is projected to create a new segment within the lubricant market, potentially accounting for 15% of total lubricant sales by 2025. Additionally, the rise of alternative fuels, such as biodiesel and synthetic fuels, necessitates the development of compatible lubricants, further expanding the market opportunities for refineries. This evolution underscores the need for refineries to adapt their product offerings to meet the changing demands of the automotive sector.

Regulatory Compliance and Environmental Standards

Regulatory compliance and stringent environmental standards are significant drivers influencing the Specialties Lube Oil Refinery Market. Governments worldwide are implementing regulations aimed at reducing emissions and promoting the use of environmentally friendly lubricants. For instance, the European Union's REACH regulation mandates that lubricants must meet specific safety and environmental criteria. This regulatory landscape compels refineries to innovate and develop specialty lubricants that align with these standards. As a result, the market is witnessing a shift towards bio-based and biodegradable lubricants, which are anticipated to capture a larger market share, potentially reaching 20% by 2025. This trend not only enhances the sustainability of the industry but also opens new avenues for growth.