North America : Growing Renewable Energy Sector

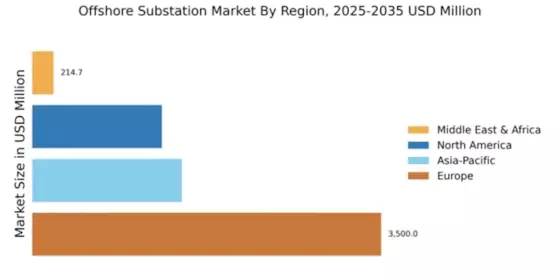

The Offshore Substation Market in North America is projected to reach $1,300.0 million by 2025, driven by increasing investments in renewable energy and supportive government policies. The region is witnessing a surge in offshore wind projects, spurred by regulatory incentives aimed at reducing carbon emissions. The demand for efficient energy transmission solutions is also on the rise, further catalyzing market growth.

Leading the charge in this market are the United States and Canada, with significant contributions from states like California and Texas. Key players such as General Electric and Siemens are actively involved in developing innovative offshore substations. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing technological capabilities and market reach, positioning North America as a vital player in the global offshore substation arena.

Europe : Market Leader in Offshore Solutions

Europe holds the largest share of the Offshore Substation Market, valued at $3,500.0 million in 2025. The region's growth is fueled by ambitious renewable energy targets and substantial investments in offshore wind farms. Regulatory frameworks, such as the European Green Deal, are pivotal in driving demand for offshore substations, ensuring a sustainable energy transition across member states.

Countries like Germany, the UK, and Denmark are at the forefront, hosting numerous offshore projects. Major players, including ABB and Schneider Electric, are leveraging advanced technologies to enhance efficiency and reliability. The competitive landscape is robust, with a focus on innovation and sustainability, positioning Europe as a leader in The Offshore Substation.

Asia-Pacific : Emerging Market with High Potential

The Asia-Pacific Offshore Substation Market is expected to reach $1,500.0 million by 2025, driven by rapid industrialization and increasing energy demands. Countries in this region are investing heavily in offshore wind energy to meet their growing electricity needs and reduce reliance on fossil fuels. Government initiatives and favorable policies are further propelling market growth, making it a key area for future investments.

China and Japan are leading the charge, with significant offshore wind projects underway. Key players like Mitsubishi Electric and Hitachi Energy are actively participating in this market, focusing on innovative solutions to enhance energy transmission. The competitive landscape is evolving, with new entrants and collaborations emerging to capitalize on the region's growth potential, making Asia-Pacific a vital player in the offshore substation market.

Middle East and Africa : Emerging Market Opportunities

The Offshore Substation Market in the Middle East and Africa is projected to reach $214.7 million by 2025, driven by increasing investments in renewable energy and infrastructure development. The region is gradually shifting towards sustainable energy solutions, with governments recognizing the importance of offshore wind projects. Regulatory support is essential for fostering growth in this emerging market, as countries aim to diversify their energy sources.

Leading countries in this region include South Africa and the UAE, which are exploring offshore wind potential. The competitive landscape is still developing, with key players like DNV and Aker Solutions beginning to establish a foothold. As the market matures, opportunities for innovation and collaboration will likely increase, positioning the Middle East and Africa as a growing player in the offshore substation sector.