Regulatory Compliance and Safety Standards

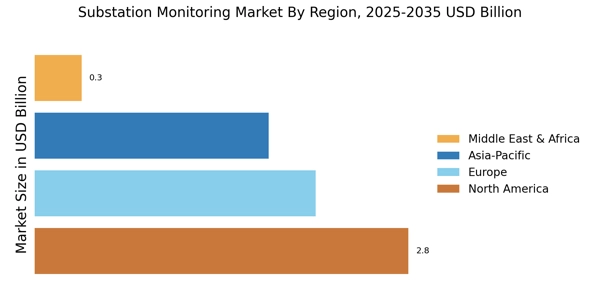

Regulatory compliance and safety standards are becoming increasingly stringent, driving the Substation Monitoring Market. Governments and regulatory bodies are imposing stricter guidelines to ensure the safety and reliability of electrical infrastructure. For instance, the implementation of the NERC CIP standards in North America mandates utilities to adopt advanced monitoring systems to protect critical infrastructure. This regulatory landscape compels utilities to invest in substation monitoring technologies that not only meet compliance requirements but also enhance operational safety. The market for substation monitoring solutions is expected to grow as utilities seek to align with these regulations, ensuring that they can operate within legal frameworks while minimizing risks associated with electrical failures.

Increasing Demand for Reliable Power Supply

The rising demand for a reliable power supply is a primary driver for the Substation Monitoring Market. As urbanization and industrialization continue to expand, the need for uninterrupted electricity becomes paramount. This demand is reflected in the increasing investments in power infrastructure, with the global power sector projected to reach a value of over 2 trillion USD by 2025. Enhanced monitoring systems in substations are essential to ensure that power distribution remains stable and efficient. By implementing advanced monitoring technologies, utilities can preemptively identify potential failures, thereby reducing downtime and improving service reliability. This trend indicates a growing recognition of the importance of robust substation monitoring solutions in maintaining the integrity of power supply networks.

Growing Investment in Smart Grid Infrastructure

The growing investment in smart grid infrastructure is a crucial driver for the Substation Monitoring Market. Governments and private entities are increasingly recognizing the need for modernizing electrical grids to enhance efficiency and reliability. This investment trend is evident in various initiatives aimed at upgrading aging infrastructure and integrating smart technologies. For example, the U.S. Department of Energy has allocated billions of dollars towards smart grid projects, which include advanced substation monitoring systems. As these investments materialize, the demand for innovative monitoring solutions is likely to surge, as utilities seek to optimize their operations and improve service delivery through enhanced grid management.

Technological Advancements in Monitoring Solutions

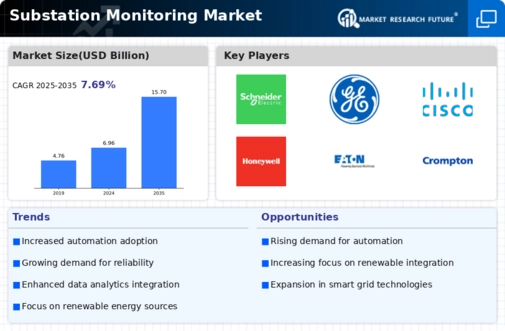

Technological advancements in monitoring solutions are significantly influencing the Substation Monitoring Market. Innovations such as artificial intelligence, machine learning, and big data analytics are being integrated into monitoring systems, enhancing their capabilities. These technologies enable real-time data analysis, predictive maintenance, and improved decision-making processes. The market for smart grid technologies, which includes advanced substation monitoring systems, is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 20% in the coming years. As utilities adopt these cutting-edge technologies, the efficiency and reliability of power distribution networks are expected to improve, further driving the demand for sophisticated monitoring solutions.

Rising Focus on Energy Efficiency and Sustainability

The rising focus on energy efficiency and sustainability is shaping the Substation Monitoring Market. As environmental concerns gain prominence, utilities are increasingly adopting practices that promote energy conservation and reduce carbon footprints. Substation monitoring systems play a vital role in this transition by enabling utilities to optimize energy distribution and minimize losses. The market for energy-efficient technologies is expected to witness substantial growth, with projections indicating a significant increase in investments in sustainable energy solutions. By implementing advanced monitoring systems, utilities can not only enhance operational efficiency but also contribute to broader sustainability goals, thereby driving the demand for substation monitoring technologies.