Rising Demand for Renewable Energy

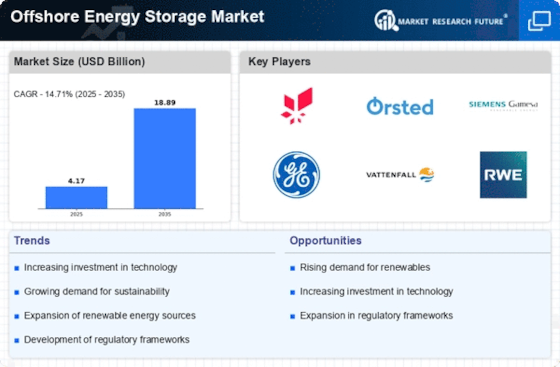

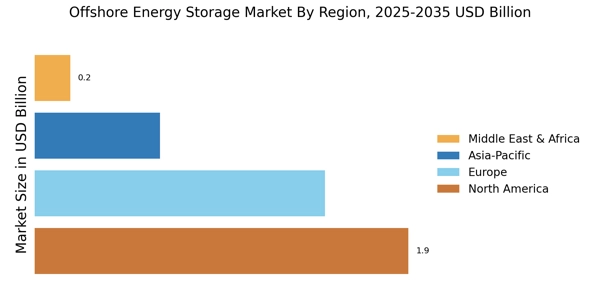

The Offshore Energy Storage Market is experiencing a notable surge in demand for renewable energy sources. As nations strive to meet ambitious climate targets, the integration of offshore energy storage solutions becomes increasingly vital. According to recent data, the offshore wind capacity is projected to reach 234 GW by 2030, necessitating efficient energy storage systems to manage the intermittent nature of wind energy. This demand is further fueled by the growing recognition of the need for energy security and resilience against climate change impacts. Consequently, the Offshore Energy Storage Market is poised for substantial growth as stakeholders seek innovative solutions to harness and store renewable energy effectively.

Growing Awareness of Energy Resilience

Growing awareness of energy resilience is emerging as a pivotal driver for the Offshore Energy Storage Market. As extreme weather events and natural disasters become more frequent, the need for reliable energy systems is increasingly recognized. Offshore energy storage solutions provide a means to enhance grid stability and ensure continuous power supply during disruptions. This awareness is prompting utilities and governments to invest in offshore storage technologies as a safeguard against potential energy crises. The Offshore Energy Storage Market is thus positioned to expand as stakeholders prioritize resilience and reliability in their energy strategies.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver for the Offshore Energy Storage Market. Governments and private entities are channeling significant resources into enhancing offshore energy infrastructure, including storage facilities. For instance, the European Union has allocated over 25 billion euros for offshore renewable energy projects, which includes energy storage initiatives. This influx of capital is likely to accelerate the deployment of advanced storage technologies, thereby improving the efficiency and reliability of offshore energy systems. As infrastructure continues to evolve, the Offshore Energy Storage Market stands to benefit from enhanced operational capabilities and increased market participation.

Technological Innovations in Energy Storage

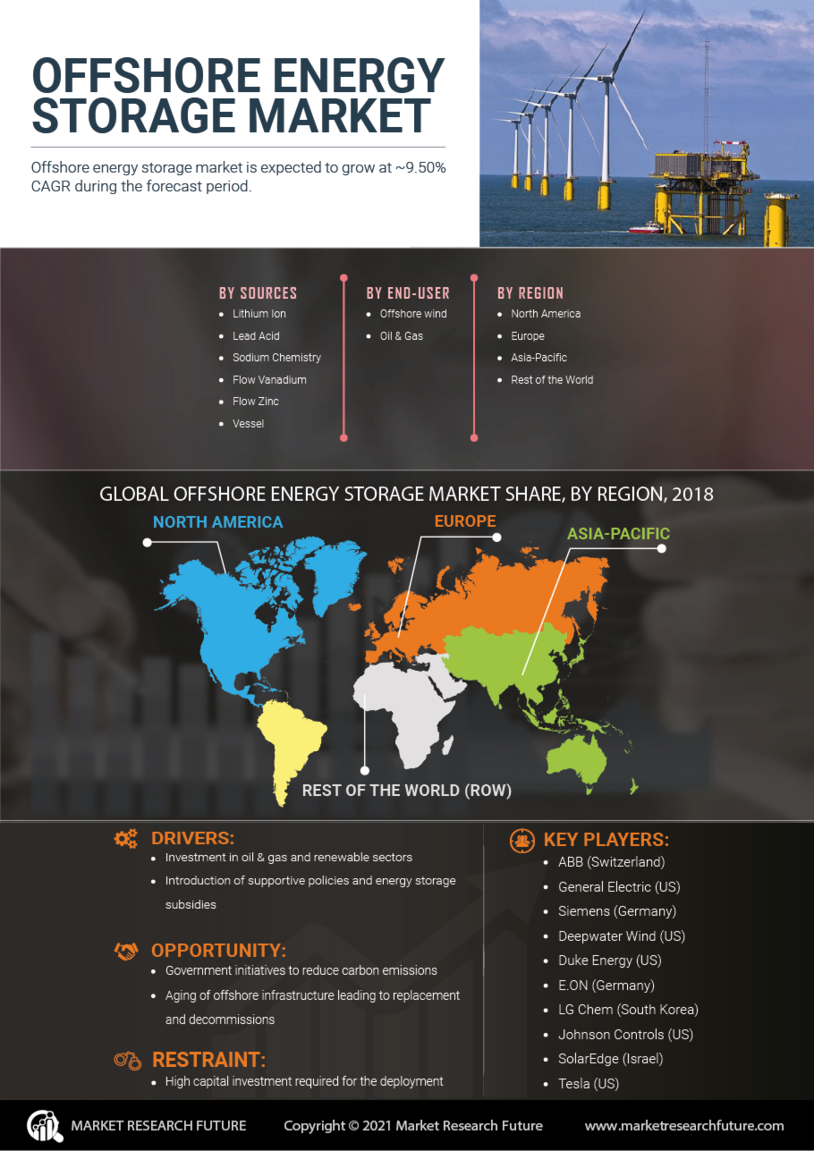

Technological innovations are reshaping the Offshore Energy Storage Market, leading to more efficient and cost-effective solutions. Recent advancements in battery technologies, such as lithium-ion and flow batteries, are enhancing energy storage capabilities, allowing for greater energy retention and discharge rates. The market is witnessing a shift towards hybrid systems that combine various storage technologies, optimizing performance and reducing costs. As these innovations proliferate, they are expected to drive down the levelized cost of energy storage, making offshore solutions more attractive to investors and operators alike. This trend indicates a promising future for the Offshore Energy Storage Market as it adapts to evolving technological landscapes.

Increasing Regulatory Support for Clean Energy

Increasing regulatory support for clean energy initiatives is significantly influencing the Offshore Energy Storage Market. Governments are implementing policies and incentives to promote the adoption of renewable energy and associated storage solutions. For example, various countries have introduced feed-in tariffs and tax credits for offshore energy projects, which enhance the economic viability of energy storage systems. This regulatory environment encourages investment and innovation within the Offshore Energy Storage Market, as stakeholders seek to align with national energy goals. The supportive framework is likely to catalyze the growth of offshore energy storage solutions, fostering a more sustainable energy future.