Market Charts and Projections

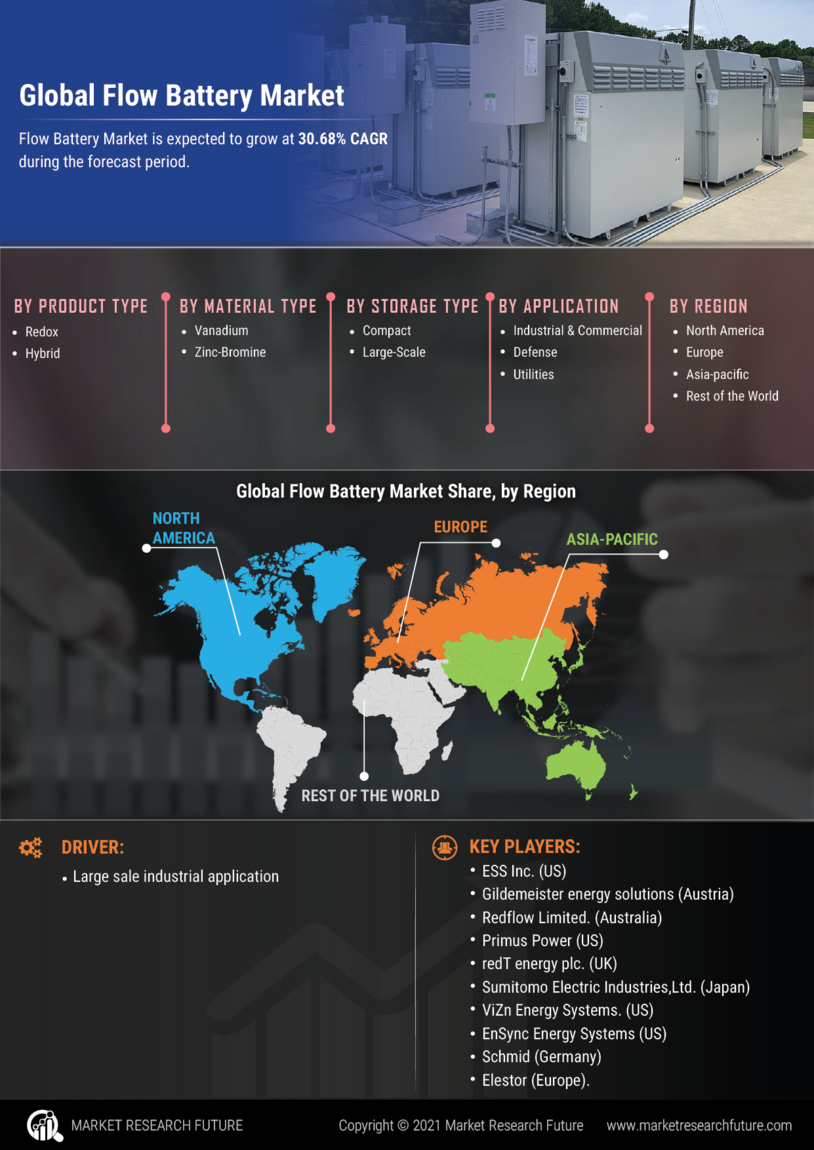

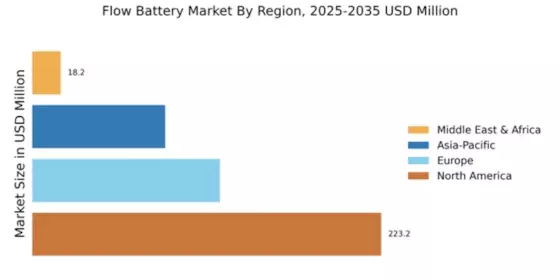

The Flow Battery Market is characterized by dynamic growth projections and evolving trends. The market is expected to expand from a valuation of 0.45 USD Billion in 2024 to an impressive 8.47 USD Billion by 2035. This growth trajectory indicates a robust compound annual growth rate (CAGR) of 30.58% from 2025 to 2035. The charts illustrate the anticipated market expansion, highlighting key drivers such as technological advancements, government policies, and increasing demand for renewable energy storage. These visual representations provide a comprehensive overview of the market's potential, underscoring the importance of flow batteries in the global energy landscape.

Government Incentives and Policies

Government initiatives and policies significantly influence the Flow Battery Market, as many countries implement supportive measures to promote energy storage technologies. Incentives such as tax credits, grants, and subsidies encourage the adoption of flow batteries, particularly in renewable energy projects. For example, various governments are establishing frameworks that prioritize energy storage solutions to enhance grid stability and reliability. These policies not only stimulate market growth but also foster innovation within the industry. As governments recognize the importance of energy storage in achieving climate goals, the flow battery market is likely to benefit from increased funding and support, further driving its expansion.

Growing Applications in Electric Vehicles

The Flow Battery Industry is witnessing a notable increase in applications within the electric vehicle sector. Flow batteries offer several advantages, including longer cycle life and faster charging capabilities, making them an attractive option for electric vehicle manufacturers. As the demand for electric vehicles continues to rise, driven by environmental concerns and regulatory pressures, flow batteries are positioned to play a significant role in this market. Their scalability and ability to provide high energy output align well with the needs of electric vehicle technology. This trend suggests a promising future for flow batteries, potentially contributing to the market's growth trajectory through 2035.

Increasing Demand for Renewable Energy Storage

The Flow Battery Market experiences a surge in demand for energy storage solutions, driven by the global transition towards renewable energy sources. As countries aim to reduce carbon emissions, the need for efficient energy storage systems becomes paramount. Flow batteries, with their ability to store large amounts of energy for extended periods, are well-suited for this purpose. In 2024, the market is valued at 0.45 USD Billion, indicating a growing recognition of flow batteries as a viable option for integrating renewable energy into the grid. This trend is expected to continue, with projections suggesting a market growth to 8.47 USD Billion by 2035.

Technological Advancements in Flow Battery Systems

Technological innovations play a crucial role in the Flow Battery Market, enhancing the efficiency and performance of flow battery systems. Recent advancements in materials and designs have led to improved energy density and cycle life, making flow batteries more competitive against traditional energy storage technologies. For instance, developments in vanadium redox flow batteries have demonstrated increased efficiency and lower costs. These innovations not only attract investments but also expand the application range of flow batteries in various sectors, including grid storage and electric vehicles. As technology continues to evolve, the market is poised for significant growth, with a projected CAGR of 30.58% from 2025 to 2035.