Rising Energy Demand

The Fixed Offshore Wind Energy Market is experiencing a notable surge in energy demand, driven by increasing population and industrial activities. As countries strive to meet their energy needs sustainably, offshore wind energy emerges as a viable solution. The International Energy Agency projects that renewable energy sources, including offshore wind, will account for a significant portion of the energy mix by 2030. This growing demand for clean energy is likely to propel investments in fixed offshore wind projects, thereby enhancing the market's growth prospects. Furthermore, the transition towards electrification in various sectors, such as transportation and heating, further amplifies the need for renewable energy sources. Consequently, the Fixed Offshore Wind Energy Market is poised to benefit from this escalating demand, as stakeholders seek to harness wind energy's potential to meet future energy requirements.

Technological Innovations

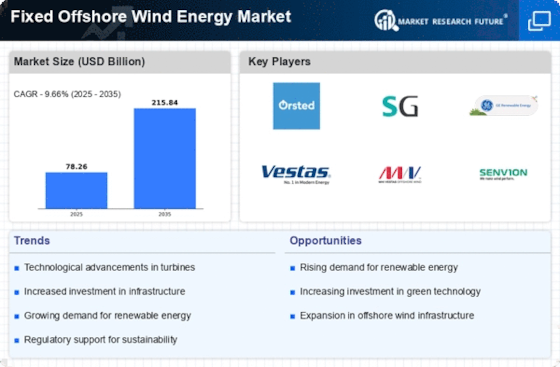

Technological advancements play a pivotal role in shaping the Fixed Offshore Wind Energy Market. Innovations in turbine design, materials, and installation techniques have significantly improved the efficiency and reliability of offshore wind farms. For instance, the development of larger and more efficient turbines has led to increased energy output, making offshore wind projects more economically viable. According to recent data, the average capacity of offshore wind turbines has increased, with some reaching capacities of over 10 MW. These advancements not only enhance energy production but also reduce the levelized cost of energy, making fixed offshore wind more competitive against traditional energy sources. As technology continues to evolve, the Fixed Offshore Wind Energy Market is likely to witness further enhancements, driving growth and attracting investment.

Environmental Sustainability Goals

The growing emphasis on environmental sustainability is a significant driver for the Fixed Offshore Wind Energy Market. As climate change concerns intensify, countries are increasingly committing to reducing their carbon footprints and transitioning to renewable energy sources. Offshore wind energy is recognized for its low environmental impact and ability to generate clean electricity. Many nations have set ambitious targets for carbon neutrality, with offshore wind playing a crucial role in achieving these goals. The potential for large-scale energy generation from offshore wind farms aligns with global sustainability objectives, making it an attractive option for policymakers and investors alike. Consequently, the Fixed Offshore Wind Energy Market is likely to benefit from this heightened focus on sustainability, as stakeholders seek to invest in clean energy solutions.

Government Policies and Incentives

Supportive government policies and incentives are crucial drivers for the Fixed Offshore Wind Energy Market. Many countries have established ambitious renewable energy targets, aiming to reduce greenhouse gas emissions and transition to cleaner energy sources. For instance, various nations have implemented feed-in tariffs, tax credits, and grants to encourage investment in offshore wind projects. These policies create a favorable environment for developers and investors, facilitating the growth of the market. Additionally, regulatory frameworks that streamline permitting processes and enhance grid integration are essential for the successful deployment of offshore wind farms. As governments continue to prioritize renewable energy, the Fixed Offshore Wind Energy Market is expected to thrive, attracting both domestic and international investments.

Investment and Financing Opportunities

The Fixed Offshore Wind Energy Market is witnessing a surge in investment and financing opportunities, driven by the increasing recognition of offshore wind as a viable energy source. Financial institutions and investors are increasingly allocating capital towards renewable energy projects, recognizing the long-term benefits and stability associated with fixed offshore wind investments. Recent reports indicate that global investments in offshore wind energy have reached unprecedented levels, with billions of dollars committed to new projects. This influx of capital not only supports the development of new offshore wind farms but also fosters innovation and technological advancements within the industry. As the market matures, the Fixed Offshore Wind Energy Market is likely to attract further investment, enhancing its growth trajectory and sustainability.