Research methodology on Nuclear Waste Management Market

Introduction

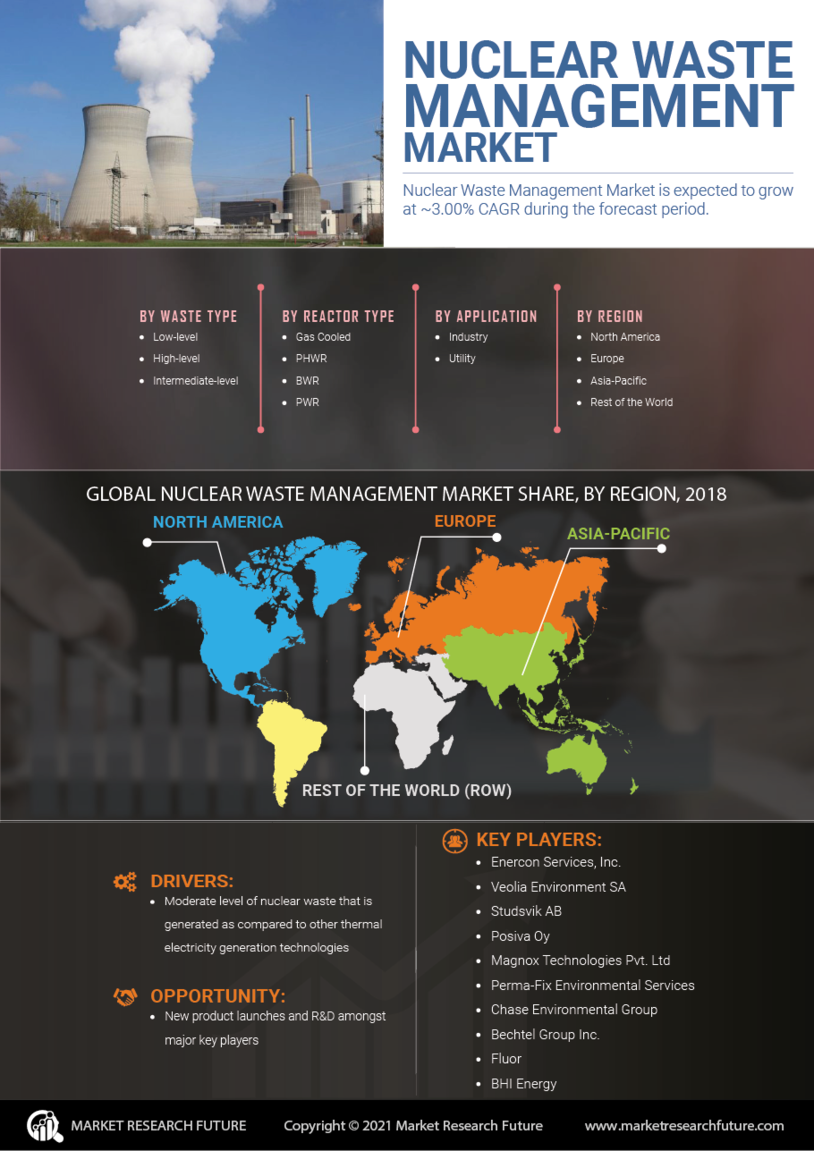

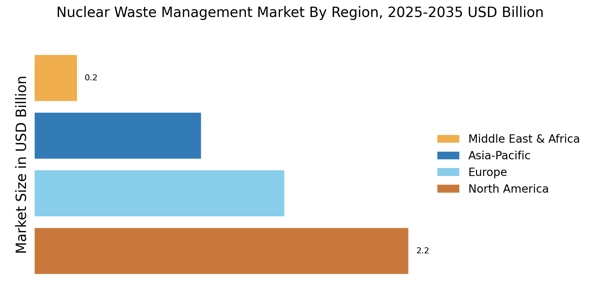

The nuclear waste management market is driven by factors such as stringent regulations governing the management of nuclear waste and increasing global energy demand. Increasing emphasis on nuclear power generation is supported by rising carbon emissions, which is expected to fuel the growth of the nuclear waste management market over the forecast period 2023 to 2030. Furthermore, the higher efficiency of nuclear plants and the rise of nuclear power as a viable source of energy are contributing to the growth of the nuclear waste management market.

The purpose of this research is to assess the growth and potential of the nuclear waste management market and to analyse the key market trends, drivers, and challenges. This report provides an in-depth understanding of the key players in the market, along with their products, segment share, competitive landscape and strategies adopted. The research also provides an assessment of the market's potential over the forecast period and its competitive landscape.

Methodology

This research conducted on the global market for Nuclear waste management consists of both primary and secondary research methodologies. The primary research is conducted through in-depth interviews and discussions with manufacturers, regulatory bodies and other key stakeholders in the nuclear waste management industry. The secondary research involves analyzing the existing trends and research data from the past five years to understand the opportunities and trends in the nuclear waste management market.

The research methodology includes the following steps:

• Determination of the research objectives:

The objectives of the research are to assess the current market size, opportunities and challenges in the nuclear waste management market, and to analyse the key trends, drivers, and strategies in the market.

• Data collection and analysis:

Data for the research is obtained from both primary and secondary sources. Information from industry sources such as regulatory bodies, industry associations, and industry experts is collected through in-depth interviews and discussions. Secondary data is collected through sources such as journals, financial databases, and industry reports.

• Estimation and modelling of the market:

The final step involves modelling the collected information and converting the data into a quantitative format. This helps to forecast the market devices and provide a better understanding of the market.

• Interpretation of findings:

The final step involves analysing the gathered data and drawing inferences from the findings. The results of the research are summarised in this report and are also used to recommend strategies for the players in the nuclear waste management market.

Conclusion

This research report on the nuclear waste management market covers an elaborate analysis of the growth of the market over the forecast period 2023 to 2030. The report provides insights into the drivers, restraints and market potential of the nuclear waste management market. The research focuses on assessing the market potential and competitive landscape; the report also provides an assessment of the strategies adopted by the key players in the market. The research process combines secondary research, primary interviews and modelling techniques to deliver an analysis of the market. The findings of the research can be used by companies to gain competitive intelligence, improve their market reach and develop new products.