Aging Nuclear Infrastructure

The aging nuclear infrastructure presents a significant driver for the Nuclear Decommissioning Market. Many nuclear power plants, particularly those built in the mid-20th century, are reaching the end of their operational life. As these facilities age, the costs associated with maintenance and safety increase, prompting operators to consider decommissioning as a viable option. By 2025, it is estimated that numerous reactors will be decommissioned, leading to a surge in demand for specialized services. The decommissioning process involves complex procedures, including the safe removal of radioactive materials and the dismantling of plant structures. This complexity necessitates the expertise of specialized contractors, thereby creating opportunities within the market. The trend of aging infrastructure is expected to continue, further solidifying the Nuclear Decommissioning Market as a critical sector in the energy landscape.

Regulatory Compliance and Safety Standards

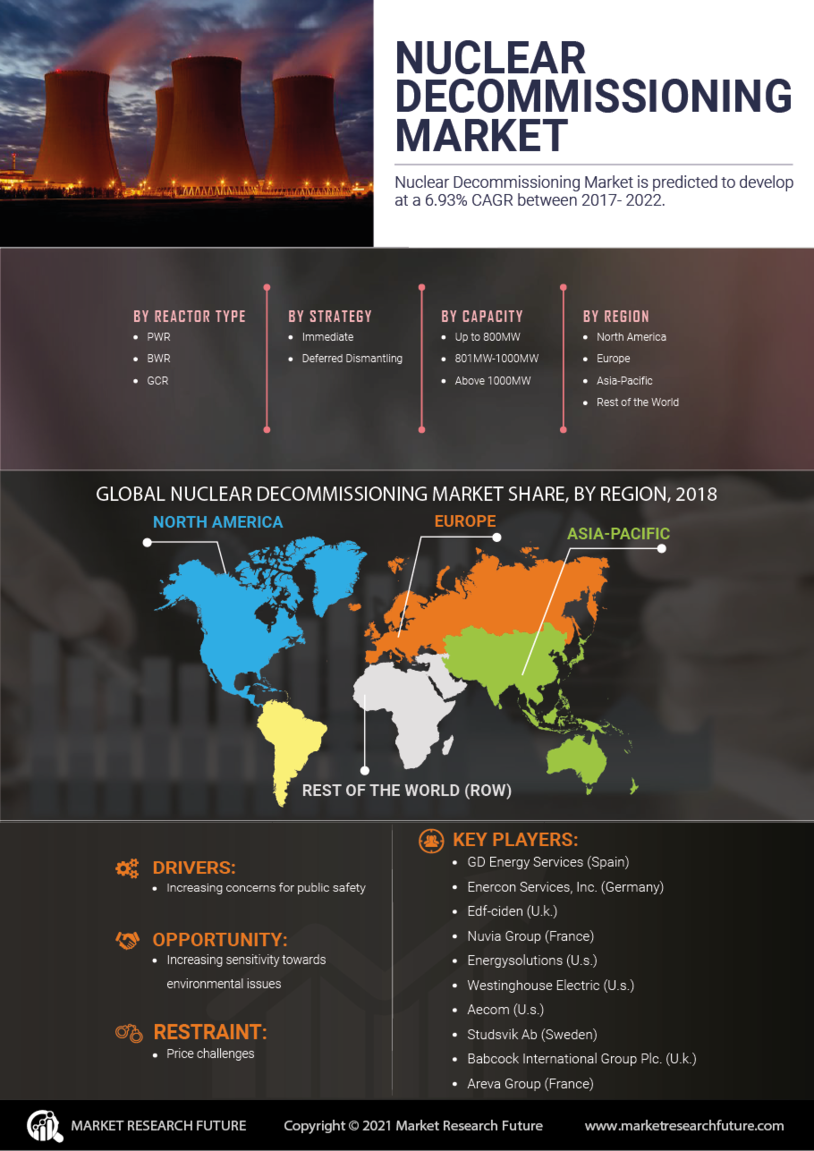

The Nuclear Decommissioning Market is heavily influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies impose rigorous guidelines to ensure the safe dismantling of nuclear facilities. This regulatory framework is designed to protect public health and the environment, thereby driving demand for decommissioning services. As of 2025, the industry is witnessing an increase in regulatory requirements, which necessitates advanced decommissioning strategies and technologies. The need for compliance with these evolving regulations is expected to propel the market forward, as companies seek to avoid penalties and ensure safe operations. Furthermore, the emphasis on safety standards fosters innovation in decommissioning methodologies, leading to more efficient and cost-effective solutions. This regulatory landscape is likely to remain a key driver in shaping the Nuclear Decommissioning Market.

Public Perception and Environmental Concerns

Public perception and environmental concerns are increasingly influencing the Nuclear Decommissioning Market. As communities become more aware of the potential risks associated with nuclear facilities, there is a growing demand for transparency and accountability in decommissioning efforts. By 2025, public engagement in discussions surrounding nuclear decommissioning is expected to intensify, prompting operators to adopt more proactive communication strategies. This shift in public sentiment is likely to drive companies to prioritize environmentally responsible decommissioning practices, thereby enhancing their reputation and fostering community trust. Additionally, addressing environmental concerns can lead to more sustainable decommissioning solutions, which may attract further investment. The interplay between public perception and environmental stewardship is poised to shape the future direction of the Nuclear Decommissioning Market.

Technological Innovations in Decommissioning

Technological innovations are transforming the Nuclear Decommissioning Market, enhancing efficiency and safety in decommissioning processes. Advanced robotics, remote monitoring systems, and innovative waste management solutions are being integrated into decommissioning projects. These technologies not only streamline operations but also minimize human exposure to hazardous environments. As of 2025, the adoption of such technologies is anticipated to increase, driven by the need for cost-effective and safe decommissioning methods. The integration of digital tools and data analytics is also enabling better project management and risk assessment. Consequently, companies that invest in these technological advancements are likely to gain a competitive edge in the Nuclear Decommissioning Market. The ongoing evolution of technology is expected to play a pivotal role in shaping the future of decommissioning practices.

Increased Investment in Decommissioning Projects

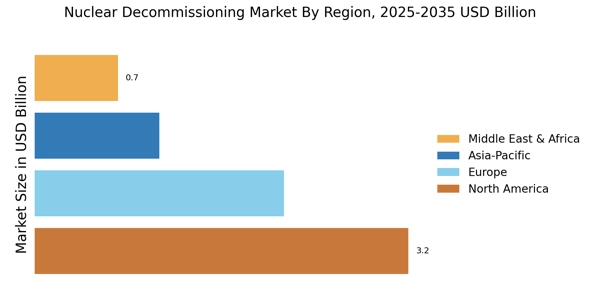

Increased investment in decommissioning projects is a notable driver for the Nuclear Decommissioning Market. As more nuclear facilities reach the end of their operational life, stakeholders are recognizing the financial and environmental imperatives of decommissioning. Investment in decommissioning not only addresses safety concerns but also facilitates the repurposing of land for alternative uses. By 2025, it is projected that investments in decommissioning will rise significantly, as governments and private entities allocate funds to ensure safe and efficient dismantling processes. This influx of capital is likely to stimulate growth within the market, enabling companies to enhance their capabilities and expand their service offerings. Furthermore, increased investment may lead to the development of new technologies and methodologies, further driving the Nuclear Decommissioning Market.