Increased Focus on Operational Efficiency

The performance analytics market is experiencing a heightened focus on operational efficiency as organizations strive to streamline processes and reduce costs. Companies are increasingly utilizing performance analytics to identify inefficiencies and optimize resource allocation. This trend is particularly evident in manufacturing and logistics sectors, where performance metrics are critical for maintaining competitiveness. Recent studies suggest that organizations leveraging performance analytics can achieve cost reductions of up to 20%. As businesses continue to prioritize efficiency, the demand for performance analytics solutions is expected to rise, further propelling the growth of the market in North America.

Regulatory Compliance and Risk Management

The performance analytics market in North America is significantly influenced by the need for regulatory compliance and effective risk management. Organizations are increasingly adopting analytics solutions to ensure adherence to industry regulations and to mitigate potential risks. The financial services sector, in particular, is witnessing a heightened focus on compliance analytics, with expenditures projected to reach $5 billion by 2025. This trend indicates that businesses are leveraging performance analytics to monitor compliance metrics and identify areas of vulnerability. Consequently, the performance analytics market is poised for growth as companies seek to enhance their risk management frameworks through data-driven insights.

Technological Advancements in Analytics Tools

Technological advancements are playing a pivotal role in shaping the performance analytics market in North America. The emergence of sophisticated analytics tools, including predictive and prescriptive analytics, is enabling organizations to derive deeper insights from their data. As businesses increasingly adopt these advanced tools, the market is expected to witness a growth rate of around 15% annually. This trend is indicative of a broader shift towards more comprehensive analytics solutions that can address complex business challenges. The integration of these technologies into existing systems is likely to enhance the overall effectiveness of performance analytics, driving further adoption across various sectors.

Growing Demand for Data-Driven Decision Making

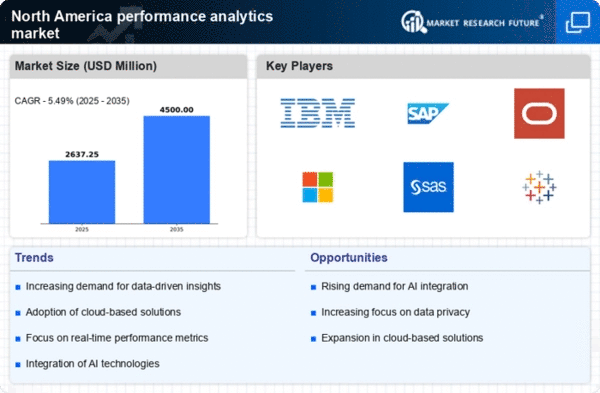

The performance analytics market in North America experiences a notable surge in demand as organizations increasingly prioritize data-driven decision making. Companies are recognizing the value of leveraging analytics to enhance operational efficiency and improve strategic planning. According to recent estimates, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is fueled by the need for actionable insights that can drive competitive advantage. As businesses strive to optimize performance metrics, the performance analytics market is positioned to benefit significantly from this trend, as organizations invest in advanced analytics tools to harness the power of their data.

Rising Importance of Customer Experience Management

In the performance analytics market, the emphasis on customer experience management is becoming increasingly pronounced. Organizations are utilizing performance analytics to gain insights into customer behavior and preferences, enabling them to tailor their offerings accordingly. This shift is reflected in the growing allocation of budgets towards analytics solutions, with companies in North America expected to invest over $10 billion in performance analytics tools by 2026. By understanding customer interactions and satisfaction levels, businesses can enhance their service delivery, thereby fostering loyalty and retention. This trend underscores the critical role of performance analytics in shaping customer-centric strategies.