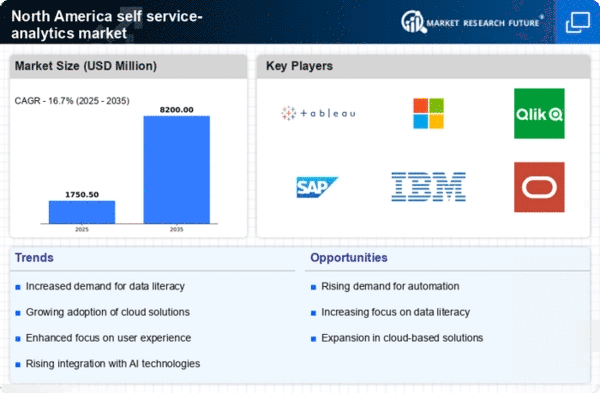

Increased Focus on Data Literacy

The self service-analytics market in North America is being propelled by an increased focus on data literacy across organizations. Companies are recognizing that equipping employees with the skills to interpret and analyze data is essential for maximizing the value of analytics tools. A recent survey revealed that 65% of organizations are implementing training programs to enhance data literacy among their workforce. This emphasis on education is likely to drive the adoption of self service-analytics solutions, as more employees become capable of utilizing these tools effectively, thereby contributing to the growth of the self service-analytics market.

Rise of Business Intelligence Tools

The self service-analytics market in North America is witnessing a notable rise in the adoption of business intelligence (BI) tools. These tools enable users to generate reports and dashboards independently, fostering a culture of self-sufficiency in data analysis. Recent data suggests that the BI market is projected to grow at a CAGR of 10% over the next five years, indicating a robust appetite for self service solutions. As organizations increasingly invest in BI technologies, the self service-analytics market is poised to benefit from this trend, as more users seek to leverage data for strategic advantage.

Growing Demand for Data-Driven Decision Making

The self service-analytics market in North America is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are seeking to empower employees at all levels with tools that facilitate data analysis without the need for extensive technical expertise. This trend is reflected in a report indicating that 70% of organizations are prioritizing data analytics initiatives to enhance operational efficiency. As businesses strive to remain competitive, the self service-analytics market is likely to see continued growth, driven by the need for timely insights and informed decision-making processes.

Emphasis on Cost Efficiency and Resource Optimization

The self service-analytics market in North America is influenced by an emphasis on cost efficiency and resource optimization. Organizations are under pressure to reduce operational costs while maximizing the value derived from their data assets. Self service-analytics solutions offer a way to achieve this by enabling users to conduct analyses without relying on IT departments, thereby streamlining processes and reducing costs. A study indicates that companies utilizing self service analytics can save up to 30% on data management expenses. This focus on efficiency is likely to drive further investment in the self service-analytics market, as businesses seek to optimize their resources.

Advancements in Artificial Intelligence and Machine Learning

The self service-analytics market in North America is benefiting from advancements in artificial intelligence (AI) and machine learning (ML) technologies. These innovations are enabling more sophisticated data analysis capabilities, allowing users to uncover insights that were previously difficult to obtain. The integration of AI and ML into self service-analytics tools is expected to enhance user experience and drive adoption. As organizations increasingly seek to leverage these technologies, the self service-analytics market is likely to expand, with a projected growth rate of 15% over the next few years, reflecting the potential of AI-driven analytics.