Expansion of E-Commerce Platforms

The rapid expansion of e-commerce platforms in South America significantly influences the performance analytics market. As online shopping continues to gain traction, businesses are increasingly reliant on analytics to optimize their digital strategies. The performance analytics market is witnessing a growing need for tools that can analyze customer interactions, sales data, and website performance. Recent data indicates that e-commerce sales in the region are expected to reach $100 billion by 2025, driving demand for sophisticated analytics solutions. Companies are focusing on understanding consumer behavior through performance analytics, enabling them to tailor their offerings and enhance customer experiences. This trend underscores the critical role of analytics in navigating the evolving e-commerce landscape.

Growing Demand for Real-Time Insights

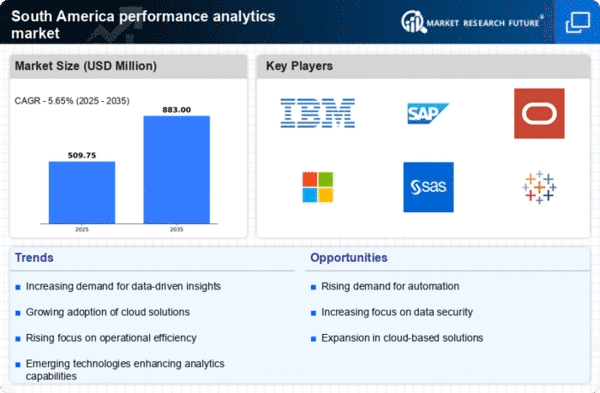

The performance analytics market in South America experiences a notable surge in demand for real-time insights. Businesses increasingly recognize the necessity of immediate data analysis to enhance decision-making processes. This trend is particularly evident in sectors such as retail and finance, where timely information can lead to competitive advantages. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. Companies are investing in performance analytics tools that provide instant feedback on operational efficiency, customer behavior, and market trends. This shift towards real-time analytics is reshaping the performance analytics market, as organizations seek to leverage data for strategic planning and operational improvements.

Regulatory Compliance and Reporting Needs

The performance analytics market in South America is increasingly shaped by the need for regulatory compliance and reporting. As governments implement stricter regulations regarding data usage and privacy, businesses are compelled to adopt analytics solutions that ensure compliance. The performance analytics market is witnessing a growing demand for tools that facilitate accurate reporting and data management. Recent legislative changes have heightened the focus on transparency and accountability, prompting organizations to invest in analytics capabilities that can streamline compliance processes. This trend is particularly pronounced in sectors such as finance and healthcare, where regulatory requirements are stringent. Consequently, the performance analytics market is evolving to meet these compliance challenges, offering solutions that integrate seamlessly with existing systems.

Increased Investment in Digital Transformation

In South America, organizations are channeling substantial investments into digital transformation initiatives, which in turn propels the performance analytics market. Companies across various sectors are adopting advanced technologies to streamline operations and improve efficiency. The performance analytics market is benefiting from this trend, as businesses seek to harness data-driven insights to guide their transformation efforts. Reports suggest that investments in digital technologies in the region could exceed $50 billion by 2026. This influx of capital is likely to enhance the capabilities of performance analytics tools, enabling organizations to derive actionable insights from complex data sets. As digital transformation continues to evolve, the demand for performance analytics solutions is expected to rise correspondingly.

Rising Focus on Customer Experience Management

In South America, there is a pronounced emphasis on customer experience management, which significantly impacts the performance analytics market. Businesses are increasingly aware that enhancing customer satisfaction is crucial for retention and growth. The performance analytics market is adapting to this shift by providing tools that analyze customer feedback, engagement metrics, and service quality. Companies are leveraging analytics to identify pain points in the customer journey and implement improvements. Recent surveys indicate that organizations prioritizing customer experience are likely to see a 20% increase in customer loyalty. This focus on customer-centric strategies is driving the demand for performance analytics solutions that can provide insights into customer behavior and preferences, ultimately shaping the future of the market.