Expansion of Cloud-Based Solutions

The proliferation of cloud computing technologies is significantly impacting the prescriptive analytics market in North America. Organizations are increasingly adopting cloud-based solutions due to their scalability, cost-effectiveness, and ease of access. This transition allows businesses to harness large volumes of data without the need for extensive on-premises infrastructure. As a result, the prescriptive analytics market is witnessing a notable increase in the deployment of cloud-based analytics platforms. Reports indicate that the cloud segment is expected to account for over 60% of the market share by 2026. This shift not only enhances collaboration but also enables real-time data processing, which is crucial for timely decision making.

Emphasis on Customer-Centric Strategies

The shift towards customer-centric business models is reshaping the prescriptive analytics market in North America. Companies are increasingly utilizing prescriptive analytics to understand customer behavior, preferences, and trends. By analyzing data, organizations can tailor their offerings and marketing strategies to meet customer needs more effectively. This focus on personalization is driving demand for prescriptive analytics solutions that can provide actionable insights. The prescriptive analytics market is likely to see growth as businesses recognize the importance of leveraging analytics to enhance customer satisfaction and loyalty, ultimately leading to increased revenue.

Growing Focus on Operational Efficiency

In the current business landscape, there is a pronounced emphasis on operational efficiency, which is driving the prescriptive analytics market in North America. Organizations are increasingly seeking ways to streamline processes, reduce costs, and improve productivity. Prescriptive analytics tools provide insights that help identify inefficiencies and recommend optimal resource allocation. This focus on efficiency is particularly evident in sectors such as manufacturing and logistics, where companies are leveraging analytics to enhance supply chain management. The prescriptive analytics market is thus likely to see sustained growth as businesses prioritize solutions that contribute to operational excellence and cost reduction.

Increased Investment in Advanced Analytics

Investment in advanced analytics technologies is on the rise, significantly influencing the prescriptive analytics market in North America. Organizations are allocating substantial budgets towards analytics initiatives to gain a competitive edge. This trend is reflected in the increasing number of partnerships and acquisitions within the analytics space, as companies seek to enhance their capabilities. The prescriptive analytics market is projected to benefit from this influx of capital, with estimates suggesting that spending on analytics solutions could reach $50 billion by 2027. This investment not only fosters innovation but also accelerates the development of more sophisticated prescriptive analytics tools.

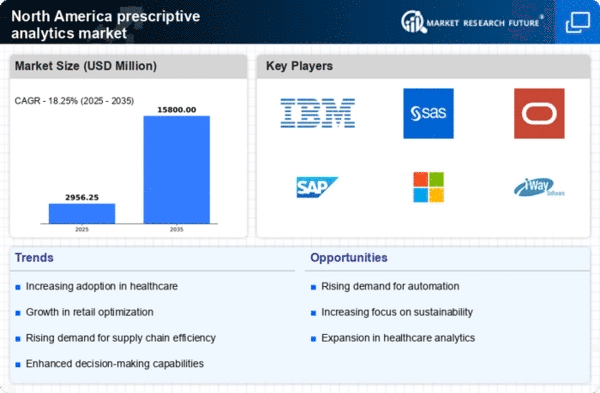

Rising Demand for Data-Driven Decision Making

The prescriptive analytics market in North America is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are leveraging advanced analytics to optimize operations, enhance customer experiences, and drive profitability. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by the need for actionable insights that can guide strategic initiatives. As businesses strive to remain competitive, the adoption of prescriptive analytics tools becomes essential for identifying trends, forecasting outcomes, and making informed decisions. The prescriptive analytics market is thus positioned to benefit from this shift towards a more analytical approach in business operations.