Shift Towards Remote Work

The transition to remote work has transformed the operational landscape for many organizations in North America. This shift has created new challenges in managing user identities and access controls, leading to an increased reliance on identity analytics solutions. The identity analytics market is adapting to these changes by providing tools that enhance visibility and control over remote access. As remote work continues to be a prevalent model, organizations are likely to invest more in identity analytics to ensure secure and efficient operations, thereby driving market growth.

Advancements in Technology

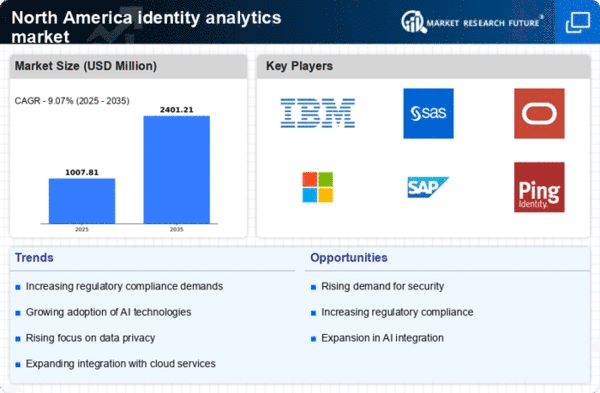

Technological innovations are significantly influencing the identity analytics market in North America. The integration of advanced technologies such as artificial intelligence and machine learning is enhancing the capabilities of identity analytics solutions, allowing for more accurate and efficient data analysis. As organizations seek to leverage these advancements, the market is projected to grow at a CAGR of 25% from 2025 to 2030. This rapid growth indicates a strong shift towards adopting sophisticated identity analytics tools that can provide deeper insights and improve decision-making processes.

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks in North America has heightened the demand for robust identity analytics solutions. Organizations are compelled to adopt advanced identity analytics market technologies to safeguard sensitive data and mitigate risks associated with identity theft and fraud. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, underscoring the urgency for effective identity management strategies. The identity analytics market is thus experiencing a surge in investment as companies seek to enhance their security postures and protect their digital assets from evolving threats.

Increased Regulatory Scrutiny

The regulatory landscape in North America is becoming increasingly stringent, with organizations facing heightened scrutiny regarding data privacy and protection. Compliance with regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) necessitates the implementation of effective identity analytics solutions. The identity analytics market is thus witnessing a surge in demand as businesses strive to ensure compliance and avoid potential penalties. It is estimated that non-compliance can result in fines reaching up to 4% of annual global revenue, further incentivizing organizations to invest in identity analytics.

Growing Demand for Customer Insights

Businesses in North America are increasingly recognizing the value of customer data in driving strategic decisions. The identity analytics market plays a crucial role in enabling organizations to analyze customer behavior and preferences, leading to improved customer experiences and targeted marketing efforts. According to recent studies, companies leveraging identity analytics can achieve up to a 20% increase in customer retention rates. This growing demand for actionable insights is propelling the adoption of identity analytics solutions, as organizations strive to remain competitive in a data-driven marketplace.