Rising Health Consciousness

The increasing awareness of health and nutrition among consumers is a pivotal driver in the meal replacement market. As individuals become more informed about the benefits of balanced diets, there is a noticeable shift towards meal replacements that offer nutritional value without compromising on taste. In North America, the demand for products that are low in sugar and high in protein has surged, with the market projected to reach approximately $3 billion by 2026. This trend indicates that consumers are actively seeking alternatives that align with their health goals, thereby propelling the growth of the meal replacement market.

Innovative Product Development

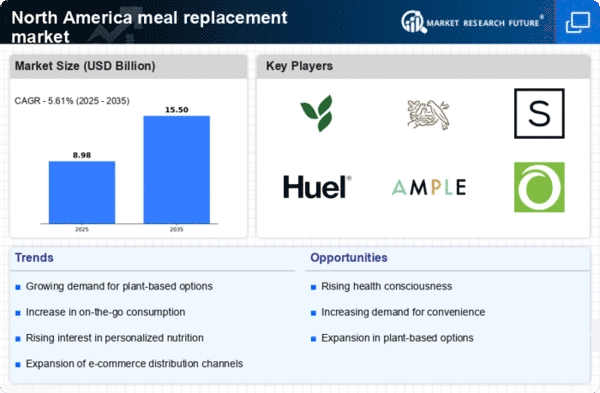

The meal replacement market is witnessing a wave of innovation, with manufacturers continuously developing new flavors, formulations, and packaging solutions. This trend is driven by consumer demand for variety and enhanced nutritional profiles. For instance, plant-based meal replacements have gained traction, appealing to the growing vegan and vegetarian population in North America. The introduction of functional ingredients, such as probiotics and superfoods, further enhances the appeal of these products. As a result, the market is projected to grow at a CAGR of 8% over the next five years, indicating a robust interest in innovative meal solutions.

E-commerce Growth and Accessibility

The expansion of e-commerce platforms has transformed the way consumers access meal replacement products. The meal replacement market benefits from the convenience of online shopping, allowing consumers to explore a wider range of options than what is typically available in brick-and-mortar stores. Recent data indicates that online sales of meal replacement products have increased by over 30% in the past year alone. This shift not only enhances accessibility but also encourages consumers to try new brands and products, thereby driving growth in the meal replacement market.

Busy Lifestyles and Time Constraints

In today's fast-paced society, the need for convenient meal solutions is more pronounced than ever. The meal replacement market is experiencing growth as busy professionals and families seek quick, nutritious options that fit into their hectic schedules. According to recent surveys, nearly 60% of North American consumers report that they often skip meals due to time constraints. This has led to an increased reliance on meal replacement products, which provide a balanced nutritional profile in a convenient format. The market is expected to expand significantly as more individuals prioritize efficiency without sacrificing health.

Increased Focus on Weight Management

The meal replacement market is significantly influenced by the rising focus on weight management among consumers. Many individuals are turning to meal replacements as a means to control caloric intake while ensuring they receive essential nutrients. In North America, approximately 40% of adults are actively trying to lose weight, which has led to a surge in demand for meal replacement shakes and bars that are low in calories yet high in protein. This trend suggests that the meal replacement market will continue to thrive as more consumers seek effective solutions for weight management.