Rising Health Consciousness

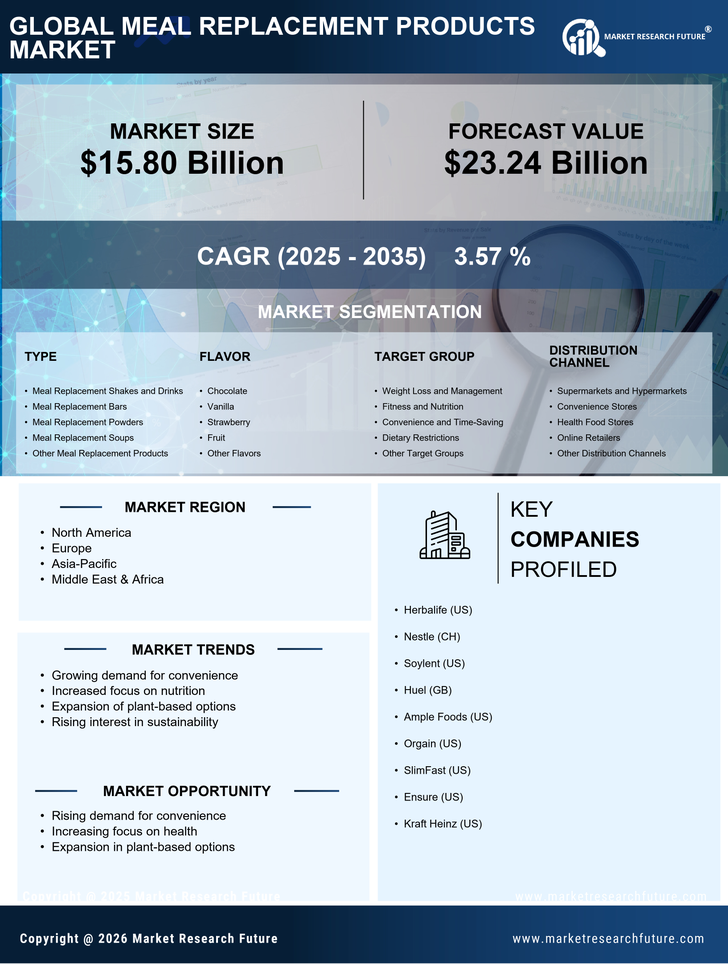

The increasing awareness of health and wellness among consumers appears to be a primary driver for the Meal Replacement Products Market. As individuals become more informed about nutrition and the impact of diet on overall health, they are seeking convenient options that align with their health goals. This trend is reflected in the growing demand for meal replacement products that offer balanced nutrition without compromising on taste. According to recent data, the meal replacement segment is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This shift towards healthier eating habits is likely to propel the Meal Replacement Products Market further, as consumers prioritize products that support their lifestyle choices.

Innovative Product Development

Innovation within the Meal Replacement Products Market is driving consumer interest and expanding market opportunities. Companies are increasingly focusing on developing new flavors, formulations, and packaging that appeal to diverse consumer preferences. The introduction of plant-based and protein-rich meal replacements has attracted a broader audience, including those with dietary restrictions or specific nutritional needs. Recent market analysis shows that the plant-based meal replacement segment is expected to witness a growth rate of over 10% in the coming years. This emphasis on innovation not only enhances product offerings but also positions the Meal Replacement Products Market as a dynamic and evolving sector, capable of adapting to changing consumer demands.

Busy Lifestyles and Convenience

The fast-paced nature of modern life has led to a significant demand for convenience in food options, which is a crucial driver for the Meal Replacement Products Market. As more individuals juggle work, family, and personal commitments, the need for quick and nutritious meal solutions has intensified. Meal replacement products offer a practical alternative for those who may not have the time to prepare traditional meals. Market data indicates that nearly 60% of consumers express a preference for on-the-go meal solutions, highlighting the potential for growth in this sector. This trend suggests that the Meal Replacement Products Market is well-positioned to cater to the needs of busy consumers seeking efficient dietary options.

E-commerce Growth and Accessibility

The rise of e-commerce has transformed the way consumers access meal replacement products, serving as a significant driver for the Meal Replacement Products Market. Online shopping platforms provide consumers with a wider selection of products, often at competitive prices, making it easier to find and purchase meal replacements. Data suggests that online sales of meal replacement products have increased by approximately 25% in the last year, indicating a shift in consumer purchasing behavior. This trend towards digital shopping is likely to continue, as consumers appreciate the convenience and accessibility that e-commerce offers. Consequently, the Meal Replacement Products Market is expected to benefit from this shift, as more consumers turn to online platforms for their dietary needs.

Increased Focus on Weight Management

The growing emphasis on weight management and fitness is a notable driver for the Meal Replacement Products Market. As more individuals seek effective solutions for weight loss or maintenance, meal replacement products are increasingly viewed as a viable option. These products often provide controlled calorie intake while ensuring essential nutrients are consumed. Market Research Future indicates that approximately 40% of consumers consider meal replacements as part of their weight management strategy. This trend suggests that the Meal Replacement Products Market is likely to see sustained growth, as consumers continue to prioritize products that assist in achieving their health and fitness goals.