Increasing Industrial Automation

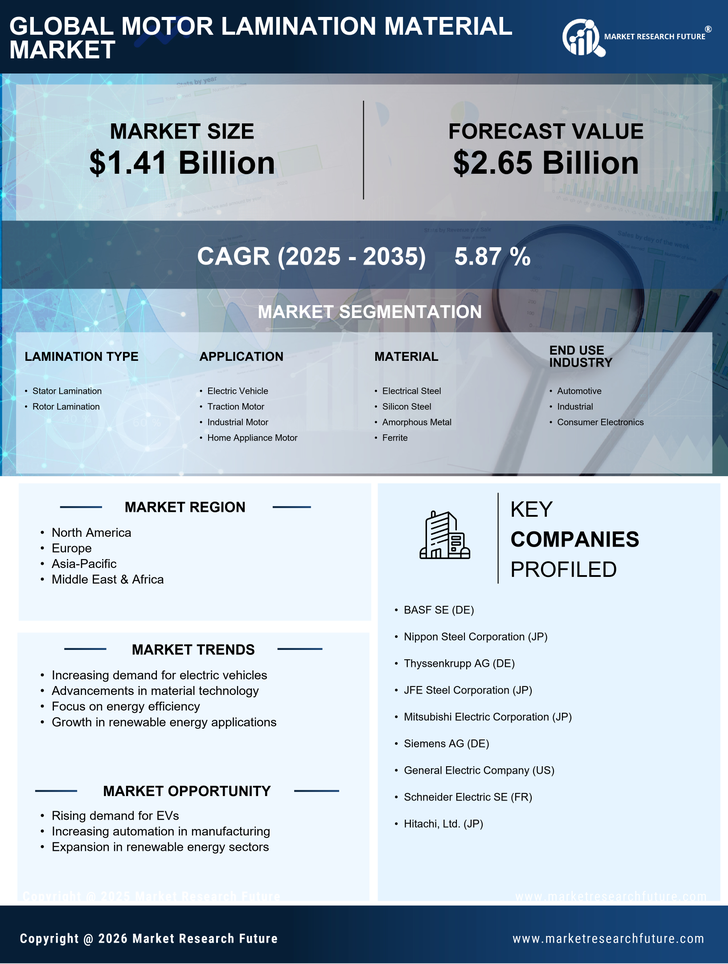

The rise of industrial automation is a significant driver for the Motor Lamination Material Market. As industries adopt automated systems to enhance productivity and efficiency, the demand for electric motors is surging. These motors require high-performance lamination materials to operate effectively. In 2025, the industrial automation market is expected to grow at a CAGR of around 12%, indicating a robust demand for electric motors and, consequently, motor lamination materials. This trend suggests that manufacturers in the Motor Lamination Material Market will need to innovate and provide materials that meet the evolving requirements of automated systems.

Growing Focus on Energy Efficiency

The Motor Lamination Material Industry. As industries and consumers alike seek to reduce energy consumption, the demand for efficient electric motors is on the rise. Motor lamination materials play a vital role in minimizing energy losses during operation. In 2025, the energy efficiency market is anticipated to reach a valuation of over 300 billion, indicating a robust demand for products that contribute to energy savings. This trend suggests that manufacturers of motor lamination materials will benefit from the increasing focus on energy-efficient solutions across various sectors.

Rising Demand for Electric Vehicles

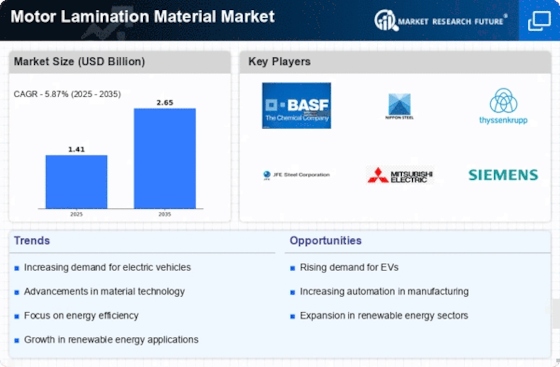

The increasing demand for electric vehicles (EVs) is a primary driver for the Motor Lamination Material Market. As manufacturers strive to enhance the efficiency and performance of electric motors, the need for high-quality lamination materials becomes paramount. In 2025, the EV market is projected to grow at a compound annual growth rate (CAGR) of approximately 20%, which directly influences the demand for motor lamination materials. These materials are essential for reducing energy losses and improving the overall efficiency of electric motors. Consequently, the Motor Lamination Material Market is likely to experience substantial growth as automotive manufacturers seek to meet the rising consumer preference for sustainable transportation solutions.

Expansion of Renewable Energy Sources

The expansion of renewable energy sources is influencing the Motor Lamination Material Market positively. As the world shifts towards sustainable energy solutions, the demand for electric motors in wind turbines and solar energy systems is increasing. These applications require high-quality motor lamination materials to ensure optimal performance and longevity. In 2025, the renewable energy sector is projected to grow at a CAGR of approximately 10%, which will likely drive the demand for motor lamination materials. This trend indicates that manufacturers in the Motor Lamination Material Market must adapt to the evolving needs of the renewable energy sector.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly impacting the Motor Lamination Material Market. Innovations such as advanced laser cutting and automated production techniques enhance the precision and quality of lamination materials. These improvements not only reduce production costs but also increase the efficiency of the final products. In 2025, the market for advanced manufacturing technologies is expected to expand, with a projected growth rate of around 15%. This trend suggests that manufacturers who adopt these technologies will likely gain a competitive edge, thereby driving the demand for high-performance motor lamination materials.