Increasing Data Traffic

The Optical Interconnect Market is experiencing a surge in demand due to the exponential growth of data traffic. With the proliferation of cloud computing, big data analytics, and the Internet of Things, the need for high-speed data transmission has never been more critical. According to recent estimates, data traffic is projected to increase by over 30% annually, necessitating advanced optical interconnect solutions. This trend compels enterprises to invest in optical interconnect technologies that can handle vast amounts of data efficiently. As a result, the Optical Interconnect Market is likely to witness substantial growth, driven by the need for faster and more reliable data transfer capabilities.

Growing Adoption of Data Centers

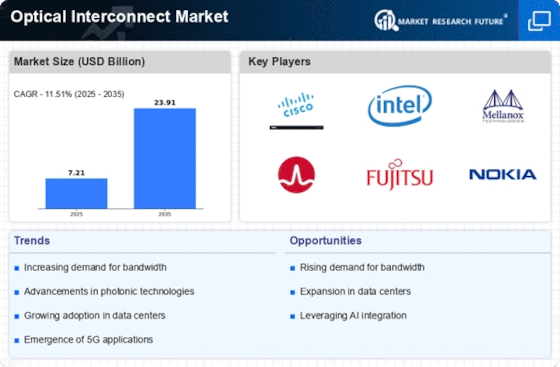

The rise in data center construction is a significant driver for the Optical Interconnect Market. As organizations increasingly rely on data centers to support their operations, the demand for efficient and high-capacity interconnect solutions is escalating. The market for data centers is projected to grow at a compound annual growth rate of approximately 10%, further fueling the need for optical interconnect technologies. These technologies provide the necessary bandwidth and speed to support the growing workloads in data centers. Consequently, the Optical Interconnect Market is poised to benefit from this trend, as data centers seek to enhance their connectivity solutions.

Advancements in Optical Technologies

Technological advancements in optical interconnects are propelling the Optical Interconnect Market forward. Innovations such as silicon photonics and advanced modulation techniques are enhancing the performance and efficiency of optical interconnects. These developments enable higher data rates and lower latency, which are essential for modern applications like 5G networks and high-performance computing. The market is expected to grow as these technologies become more accessible and cost-effective. Furthermore, the integration of optical interconnects with existing electronic systems is likely to create new opportunities for growth within the Optical Interconnect Market, as companies seek to optimize their infrastructure.

Demand for Enhanced Network Security

In an era where cybersecurity threats are on the rise, the Optical Interconnect Market is witnessing increased demand for secure communication solutions. Optical interconnects offer inherent advantages in terms of security, as they are less susceptible to electromagnetic interference and eavesdropping compared to traditional copper cables. Organizations are increasingly prioritizing secure data transmission, particularly in sectors such as finance and healthcare. This heightened focus on security is likely to drive investments in optical interconnect technologies, as businesses seek to safeguard their data. As a result, the Optical Interconnect Market may experience growth as companies adopt these secure solutions.

Regulatory Support for Fiber Optic Infrastructure

Government initiatives and regulatory support for fiber optic infrastructure development are playing a crucial role in the Optical Interconnect Market. Many governments are recognizing the importance of high-speed internet access and are investing in fiber optic networks to enhance connectivity. These initiatives not only promote economic growth but also encourage the adoption of optical interconnect technologies. As regulatory frameworks evolve to support the expansion of fiber optic infrastructure, the Optical Interconnect Market is likely to benefit from increased investments and projects aimed at improving connectivity. This supportive environment may lead to accelerated growth in the market.