Increasing Pest Resistance

The rise in pest resistance to conventional pesticides is a notable driver for the Miticides for Fruits and Vegetables Market. As pests evolve, they become less susceptible to traditional control methods, necessitating the development and adoption of more effective miticides. This trend is underscored by research indicating that certain pest populations have shown resistance rates exceeding 50% in some regions. Consequently, growers are increasingly turning to specialized miticides that target resistant strains, thereby enhancing crop protection and yield. The demand for innovative solutions is expected to propel market growth, as producers seek to maintain productivity in the face of evolving pest challenges.

Regulatory Changes and Compliance

The evolving regulatory landscape surrounding pesticide use is a critical driver for the Miticides for Fruits and Vegetables Market. Stricter regulations aimed at ensuring food safety and environmental protection are prompting manufacturers to innovate and reformulate their products. Compliance with these regulations often necessitates the development of new miticides that meet safety standards while remaining effective against pests. Market analysis indicates that regions with stringent regulatory frameworks are witnessing a shift towards safer, more sustainable miticide options. This trend not only influences product development but also shapes market dynamics as companies adapt to comply with changing regulations.

Growing Demand for Organic Produce

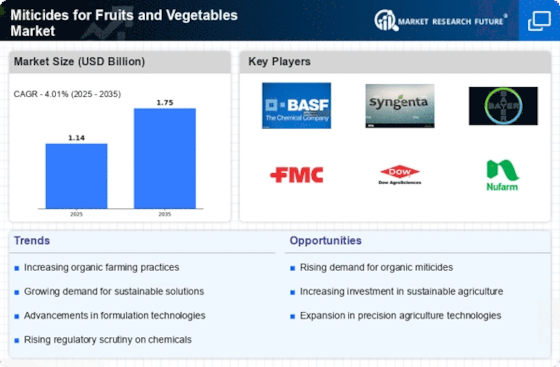

The escalating consumer preference for organic fruits and vegetables is significantly influencing the Miticides for Fruits and Vegetables Market. As health-conscious consumers increasingly seek organic options, farmers are compelled to adopt organic farming practices, which often require the use of organic miticides. Market data suggests that the organic produce sector has been expanding at a compound annual growth rate of over 10% in recent years. This shift not only drives the demand for organic miticides but also encourages research and development in this area, as producers aim to meet consumer expectations while ensuring effective pest control.

Rising Global Food Production Needs

The increasing global demand for food, driven by population growth and changing dietary preferences, is a significant factor influencing the Miticides for Fruits and Vegetables Market. As the world population is projected to reach nearly 9 billion by 2050, the pressure on agricultural systems to produce more food is intensifying. This demand necessitates effective pest management solutions to protect crops and ensure high yields. Market forecasts suggest that the need for miticides will grow in tandem with food production requirements, as farmers seek reliable methods to safeguard their harvests against pest infestations.

Technological Innovations in Agriculture

Technological advancements in agricultural practices are reshaping the Miticides for Fruits and Vegetables Market. Innovations such as precision agriculture, which utilizes data analytics and IoT devices, enable farmers to apply miticides more efficiently and effectively. This targeted approach minimizes chemical usage while maximizing pest control efficacy. Recent studies indicate that precision agriculture can reduce pesticide application rates by up to 30%, leading to cost savings and environmental benefits. As these technologies become more accessible, their adoption is likely to drive the market for advanced miticides, as growers seek to optimize their pest management strategies.