IQF Fruits & Vegetables Market Summary

As per Market Research Future analysis, the IQF Fruits & Vegetables Market Size was estimated at 5355.2 USD Million in 2024. The IQF Fruits & Vegetables industry is projected to grow from 5585.58 USD Million in 2025 to 8511.3 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The IQF Fruits and Vegetables Market is experiencing robust growth driven by health trends and technological advancements.

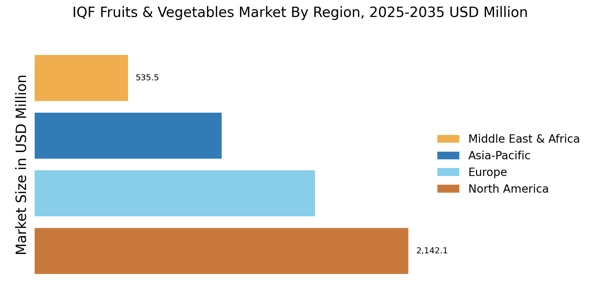

- Health consciousness among consumers is propelling the demand for IQF fruits, particularly in North America, which remains the largest market.

- Sustainability initiatives are gaining traction, especially in the Asia-Pacific region, which is recognized as the fastest-growing market.

- Technological advancements in freezing methods are enhancing the quality and shelf-life of IQF vegetables, contributing to their rapid growth.

- Rising demand for convenience foods and the expansion of the food service sector are key drivers influencing the market dynamics.

Market Size & Forecast

| 2024 Market Size | 5355.2 (USD Million) |

| 2035 Market Size | 8511.3 (USD Million) |

| CAGR (2025 - 2035) | 4.3% |

Major Players

Dole Food Company (US), Greenyard (BE), Ardo (BE), McCain Foods (CA), Pinnacle Foods (US), Bonduelle (FR), ConAgra Foods (US), Frosta (DE)