Sustainability Initiatives

The Metallized Films Market is experiencing a notable shift towards sustainability initiatives. As consumers and manufacturers alike become increasingly aware of environmental issues, there is a growing demand for eco-friendly packaging solutions. Metallized films, known for their lightweight and recyclable properties, are gaining traction as a sustainable alternative to traditional materials. This trend is further supported by regulatory frameworks that encourage the use of sustainable materials in packaging. In fact, the market for sustainable packaging is projected to reach USD 500 billion by 2027, indicating a robust growth trajectory. Companies within the Metallized Films Market are likely to invest in research and development to enhance the recyclability and biodegradability of their products, aligning with consumer preferences and regulatory demands.

Technological Advancements

Technological advancements play a pivotal role in shaping the Metallized Films Market. Innovations in coating technologies and film production processes have led to enhanced performance characteristics of metallized films, such as improved barrier properties and durability. For instance, advancements in vacuum metallization techniques have enabled manufacturers to produce films with superior optical properties and lower production costs. The market is projected to grow at a CAGR of 5.2% from 2025 to 2030, driven by these technological improvements. Furthermore, the integration of smart technologies, such as sensors and RFID tags, into metallized films is emerging as a trend, potentially revolutionizing packaging solutions. This evolution suggests that companies in the Metallized Films Market must stay abreast of technological developments to maintain competitive advantage.

Rising Demand in Emerging Markets

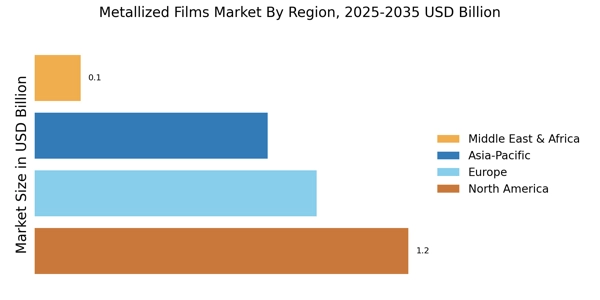

The Metallized Films Market is witnessing a surge in demand from emerging markets, particularly in Asia-Pacific and Latin America. Rapid urbanization and increasing disposable incomes in these regions are driving the need for advanced packaging solutions. For example, the Asia-Pacific region is expected to account for over 40% of the market share by 2030, fueled by the booming food and beverage sector. Additionally, the rise of e-commerce is further propelling the demand for metallized films, as they provide excellent protection and aesthetic appeal for products. This trend indicates that companies in the Metallized Films Market should strategically focus on these emerging markets to capitalize on growth opportunities and expand their market presence.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent, impacting the Metallized Films Market. Governments and regulatory bodies are implementing stricter guidelines regarding food safety and packaging materials, necessitating that manufacturers adhere to these regulations. Compliance with safety standards not only ensures consumer protection but also enhances brand reputation. The market is expected to see a shift towards materials that meet these regulatory requirements, with an estimated 25% of the market focusing on compliant products by 2030. This trend indicates that companies in the Metallized Films Market must invest in quality assurance and compliance measures to remain competitive and meet market demands.

Consumer Preferences for Aesthetic Packaging

Consumer preferences are increasingly leaning towards aesthetic packaging, which significantly influences the Metallized Films Market. The visual appeal of products plays a crucial role in purchasing decisions, particularly in sectors such as food and cosmetics. Metallized films offer a shiny, attractive finish that enhances product visibility on shelves, thereby attracting consumers. Market Research Future indicates that products packaged in metallized films can experience up to a 30% increase in sales compared to those in standard packaging. This trend suggests that manufacturers in the Metallized Films Market must prioritize design and aesthetics in their product offerings to meet evolving consumer expectations and drive sales.