Growing Aging Population

The aging population is a critical driver of the Global Medical Telemetry Market Industry. As the global demographic shifts towards an older population, the demand for healthcare services, including telemetry solutions, is expected to rise. Older adults often have multiple chronic conditions that require continuous monitoring, making telemetry systems essential for effective management. The increasing life expectancy and the associated healthcare needs are likely to propel the market forward. This demographic trend aligns with the projected growth rate of 12.36% CAGR from 2025 to 2035, indicating a strong correlation between the aging population and the demand for advanced telemetry technologies.

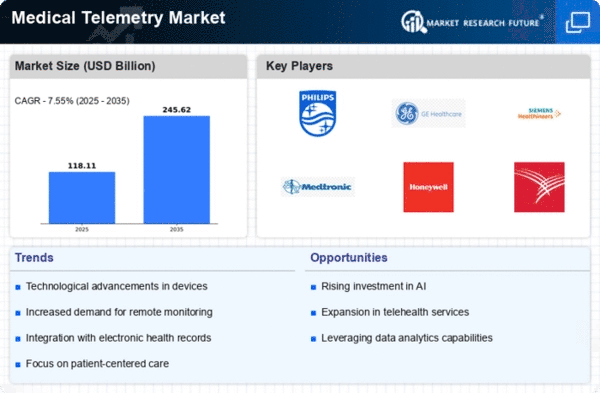

Market Growth Projections

The Global Medical Telemetry Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will expand from 0.06 USD Billion in 2024 to 0.21 USD Billion by 2035. This growth trajectory suggests a robust demand for telemetry solutions, driven by factors such as technological advancements, regulatory support, and the increasing prevalence of chronic diseases. The anticipated compound annual growth rate of 12.36% from 2025 to 2035 further underscores the market's potential. As healthcare systems continue to evolve, the integration of telemetry technologies is likely to play a crucial role in enhancing patient care and operational efficiency.

Increasing Focus on Patient-Centric Care

The Global Medical Telemetry Market Industry is witnessing a shift towards patient-centric care models, which prioritize individual patient needs and preferences. This paradigm shift encourages healthcare providers to adopt telemetry solutions that empower patients to take an active role in managing their health. Telemetry systems enable patients to monitor their vital signs from home, fostering a sense of autonomy and engagement. As the market evolves, the emphasis on personalized healthcare solutions is likely to drive demand for telemetry technologies. This trend aligns with the projected compound annual growth rate of 12.36% from 2025 to 2035, indicating a sustained interest in patient-centered approaches.

Rising Demand for Remote Patient Monitoring

The Global Medical Telemetry Market Industry experiences a notable increase in demand for remote patient monitoring solutions. This trend is driven by the growing prevalence of chronic diseases, which necessitate continuous health monitoring. For instance, conditions such as diabetes and cardiovascular diseases require regular tracking of vital signs. The market is projected to reach 0.06 USD Billion in 2024, reflecting the increasing adoption of telemetry systems. As healthcare providers seek to enhance patient outcomes and reduce hospital readmissions, the integration of telemetry technology into home care settings is likely to expand, thereby contributing to market growth.

Regulatory Support for Telehealth Initiatives

Regulatory frameworks are increasingly supportive of telehealth initiatives, which significantly impacts the Global Medical Telemetry Market Industry. Governments worldwide are implementing policies that promote the use of telemedicine and remote monitoring technologies. For example, recent legislative measures aim to expand reimbursement for telehealth services, thereby incentivizing healthcare providers to adopt telemetry solutions. This regulatory support is expected to facilitate market growth, as it encourages investment in innovative telemetry technologies. The anticipated increase in market value from 0.06 USD Billion in 2024 to 0.21 USD Billion by 2035 underscores the potential for growth driven by favorable regulatory environments.

Technological Advancements in Telemetry Systems

Technological innovations play a pivotal role in shaping the Global Medical Telemetry Market Industry. The introduction of advanced telemetry devices, such as wearable sensors and mobile health applications, enhances the accuracy and efficiency of patient monitoring. These devices facilitate real-time data transmission, allowing healthcare professionals to make informed decisions promptly. The anticipated growth from 0.06 USD Billion in 2024 to 0.21 USD Billion by 2035 indicates a robust market trajectory, driven by these technological advancements. Furthermore, the integration of artificial intelligence and machine learning algorithms into telemetry systems may improve predictive analytics, thus enhancing patient care.