Market Trends

Key Emerging Trends in the Medical Telemetry Market

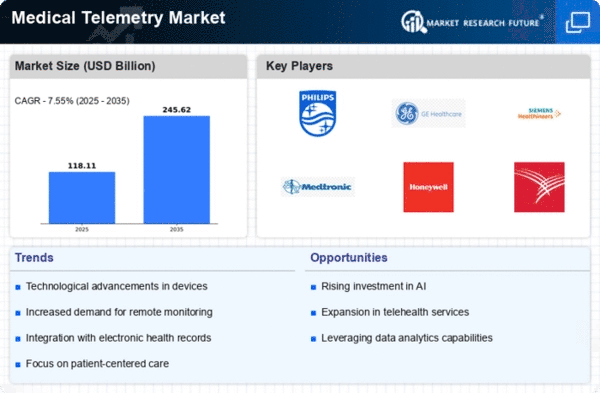

The Medical Telemetry market is in its boom phase owing to increased technological development. Thanks to the technological innovations in wireless communication, sensor technologies, and data analytics, there have emerged more advanced, accurate and reliable medical telemetry devices. The increasing occurrence of chronic diseases has greatly contributed to the increase of the medical telemetry market. Diseases such as cardiovascular diseases, diabetes, respiratory diseases, etc. need a constant tracking that in turn gives rise to a need for telemetry solutions which offer real-time data so that intervention and management take place in a timely manner. Notably, the trend in healthcare has moved to remote patient monitoring, more so with a significant push for telehealth across the world. Medical telemetry has become a vital part of effective management systems that ensure remotely monitoring of patients and timely delivery of necessary interventions by health professionals, thereby minimizing the number of hospital visits. The aging population across the globe is a demographic trend which fosters market growth. With growth of elderly population medical telemetry solutions become more and more popular, since these technologies are necessary to monitor vital signs and to manage chronic diseases shown for elders. The medical telemetry solutions have been slowly adopted until COVID-19 made additions of the telemetry systems inevitable. Remote patient monitoring and management trends are of significant value for health professionals and practicians due to unavoidable risk of virus transmission through physical contact and this in turn has fueled the market demand. A major trend which is transforming the market of medical telemetry systems is the addition of artificial intelligence to these devices. AI algorithms improve the telemetry data analysis allowing preciser predictions and early identification of possible health complications that in return translate to better treatment outcomes. Although there are positive global meripherein trends in discussing medical telemetry markets, interoperability is a challenge it faces. Thus, the combination of various telemetry tools on the one hand and on the other, allowing the establishment of uninterrupted data transmission between heterogeneous systems continues to be one of the main challenges actively being overcome by the industry. With the being constant with the medical devices getting intersite, the cybersecurity matters has become much more pertinent. The safety and privacy of patient information transmitted through telemetry systems remains one of the top focuses for market players as any breach would have dire consequences. Medical telemetry is appearing differently in home healthcare. The adoption of telemetry devices at the patients’ homes opens a new direction towards market diversification since the patients can monitor themselves without having to come to clinics. The stricter regulatory requirement has created the tendency to govern the market for year. The issue of conforming to regulatory standards underpifies the safety and efficiency of market operators in their implementation of telemetry devices which in turn affects product development and strategies of market entry.

Leave a Comment