Increased Focus on Cybersecurity

In the context of the US Aerospace Defense Telemetry Market, the heightened focus on cybersecurity is a critical driver. As telemetry systems become more interconnected, the potential for cyber threats increases, necessitating robust security measures. The US government has implemented stringent cybersecurity protocols to protect sensitive data transmitted through telemetry systems. This includes compliance with the National Institute of Standards and Technology (NIST) guidelines, which aim to safeguard defense-related telemetry data. The market is witnessing a shift towards incorporating advanced encryption techniques and secure communication channels, which are essential for maintaining the integrity of telemetry data. This emphasis on cybersecurity not only protects national security interests but also fosters trust in telemetry systems, thereby contributing to the overall growth of the US Aerospace Defense Telemetry Market.

Emerging Applications in Unmanned Systems

The emergence of unmanned systems is reshaping the landscape of the US Aerospace Defense Telemetry Market. Unmanned aerial vehicles (UAVs) and other autonomous systems require sophisticated telemetry solutions for effective operation. These systems rely on telemetry for real-time monitoring, control, and data collection, which are essential for mission success. The increasing deployment of UAVs in various defense applications, such as surveillance and reconnaissance, is driving demand for advanced telemetry systems. Market analysis suggests that the segment dedicated to telemetry solutions for unmanned systems is projected to grow by 7% annually, reflecting the rising importance of these technologies in modern defense strategies. Consequently, the integration of telemetry systems into unmanned platforms is a key driver of innovation and growth within the US Aerospace Defense Telemetry Market.

Growing Demand for Real-Time Data Analysis

The demand for real-time data analysis is significantly influencing the US Aerospace Defense Telemetry Market. As military operations become increasingly complex, the need for immediate data interpretation and decision-making is paramount. Telemetry systems that provide real-time data enable defense agencies to respond swiftly to dynamic situations, enhancing operational efficiency. Recent statistics indicate that the market for real-time telemetry solutions is expected to expand by 6.5% annually, driven by the necessity for timely insights in defense operations. This trend underscores the importance of integrating advanced analytics and data visualization tools within telemetry systems, which not only improve situational awareness but also facilitate strategic planning. Consequently, the growing demand for real-time data analysis is a pivotal factor propelling the US Aerospace Defense Telemetry Market forward.

Government Investments in Defense Technology

Government investments in defense technology play a crucial role in shaping the US Aerospace Defense Telemetry Market. The US Department of Defense has consistently allocated substantial budgets towards enhancing defense capabilities, including telemetry systems. In recent years, funding for research and development in aerospace technologies has seen a notable increase, with the 2025 defense budget reflecting a commitment to advancing telemetry solutions. This financial support enables the development of cutting-edge telemetry systems that meet the evolving needs of defense operations. Furthermore, partnerships between government agencies and private sector companies foster innovation and accelerate the deployment of advanced telemetry technologies. As a result, government investments are a significant driver of growth within the US Aerospace Defense Telemetry Market, ensuring that the nation remains at the forefront of aerospace defense capabilities.

Technological Advancements in Telemetry Systems

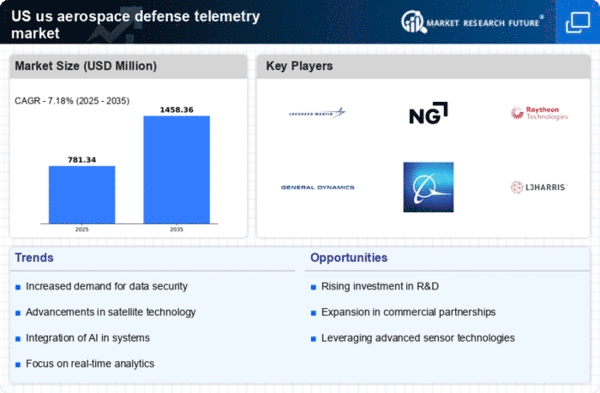

The US Aerospace Defense Telemetry Market is experiencing a surge in technological advancements that enhance the capabilities of telemetry systems. Innovations such as miniaturization of sensors, improved data processing algorithms, and integration of artificial intelligence are driving this growth. For instance, the adoption of advanced telemetry systems allows for more accurate tracking and monitoring of aerospace vehicles, which is crucial for mission success. According to recent data, the market for telemetry systems is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% over the next five years. This growth is indicative of the increasing reliance on sophisticated telemetry solutions in defense applications, thereby solidifying the importance of technological advancements in shaping the US Aerospace Defense Telemetry Market.