Growth of E-commerce and Global Trade

The expansion of e-commerce and global trade significantly influences the Global Marine Management Software Market Industry. As international shipping volumes increase, there is a heightened need for efficient logistics and supply chain management solutions. Marine management software facilitates seamless coordination between various stakeholders, including shipping lines, freight forwarders, and port authorities. This integration is essential for optimizing shipping routes, reducing transit times, and improving customer satisfaction. The ongoing growth in global trade is likely to drive further investments in marine management software, positioning it as a critical component in the logistics ecosystem.

Regulatory Compliance and Safety Standards

Regulatory compliance remains a pivotal driver in the Global Marine Management Software Market Industry. As maritime regulations become increasingly stringent, companies are compelled to adopt software solutions that ensure adherence to safety and environmental standards. This necessity is underscored by the International Maritime Organization's regulations, which mandate comprehensive reporting and monitoring. Software that automates compliance processes not only mitigates the risk of penalties but also enhances operational transparency. The industry's focus on sustainability further amplifies the demand for solutions that facilitate compliance with environmental regulations, thereby fostering a culture of safety and accountability within maritime operations.

Emerging Markets and Investment Opportunities

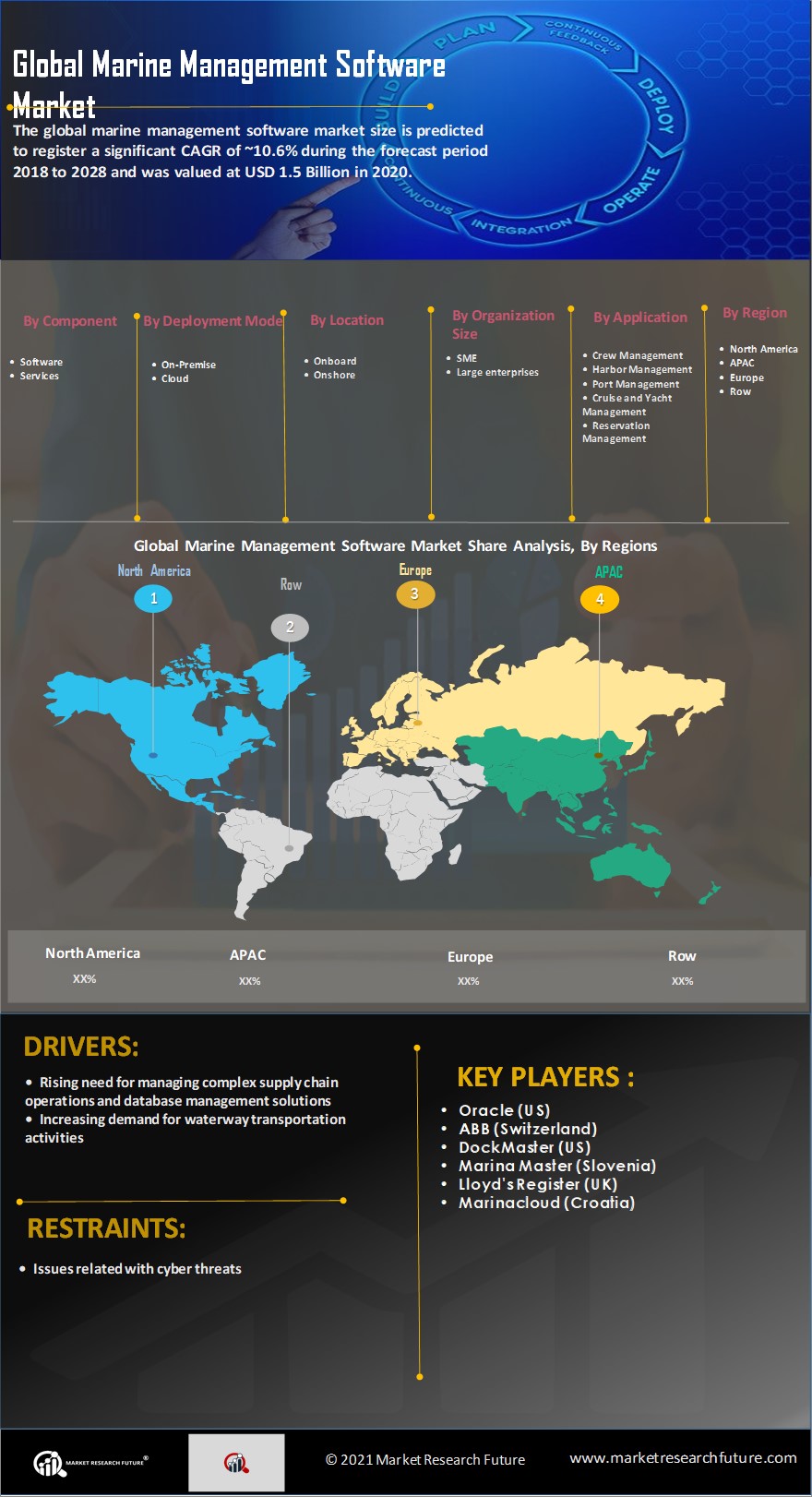

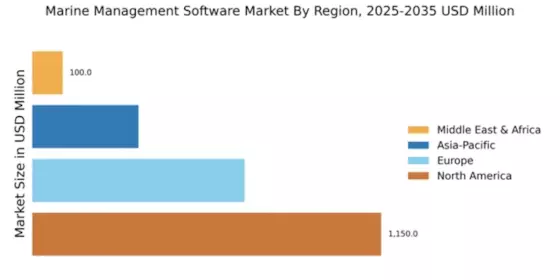

Emerging markets present substantial investment opportunities within the Global Marine Management Software Market Industry. Regions such as Asia-Pacific and Latin America are witnessing rapid industrialization and urbanization, leading to increased maritime activities. As these markets develop, the demand for marine management software is expected to rise, driven by the need for efficient fleet operations and regulatory compliance. Companies are likely to invest in software solutions that cater to the unique challenges of these regions, such as infrastructure limitations and varying regulatory landscapes. This trend indicates a promising future for the marine management software sector, as it adapts to the evolving needs of emerging markets.

Technological Advancements in Marine Software

Technological advancements play a crucial role in shaping the Global Marine Management Software Market Industry. Innovations such as artificial intelligence, machine learning, and the Internet of Things are revolutionizing how marine operations are managed. These technologies enable predictive analytics, which enhances decision-making processes and operational efficiency. For instance, AI-driven software can analyze vast amounts of data to forecast maintenance needs, thereby reducing downtime and operational costs. As the industry embraces these technologies, the demand for sophisticated marine management software is expected to rise, further propelling market growth and enhancing competitive advantage among maritime operators.

Increasing Demand for Fleet Management Solutions

The Global Marine Management Software Market Industry experiences a notable surge in demand for fleet management solutions. This trend is driven by the need for enhanced operational efficiency and cost reduction among shipping companies. As of 2024, the market is valued at approximately 2.33 USD Billion, reflecting the industry's shift towards digitalization. Companies are increasingly adopting software that provides real-time tracking, maintenance scheduling, and compliance management. This shift not only optimizes resource allocation but also improves safety standards, thereby aligning with global regulatory requirements. The growth trajectory suggests that by 2035, the market could reach 6.53 USD Billion, indicating a robust CAGR of 9.82% from 2025 to 2035.