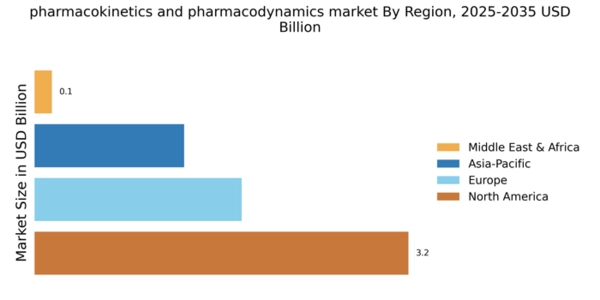

North America : Market Leader in Innovation

North America continues to lead the pharmacokinetics pharmacodynamics market, holding a significant share of 3.25B in 2025. The region's growth is driven by advanced research facilities, a robust healthcare infrastructure, and increasing investments in biopharmaceuticals. Regulatory support from agencies like the FDA further catalyzes innovation, ensuring rapid approval processes for new therapies and drugs. The competitive landscape is characterized by major players such as Pfizer, Johnson & Johnson, and Merck & Co., which are at the forefront of developing cutting-edge solutions. The U.S. remains the largest market, with Canada also contributing to growth through supportive policies and collaborations. The presence of leading pharmaceutical companies fosters a dynamic environment for research and development, ensuring sustained market expansion.

Europe : Emerging Regulatory Frameworks

Europe's pharmacokinetics pharmacodynamics market is valued at 1.8B in 2025, driven by increasing demand for personalized medicine and stringent regulatory frameworks. The European Medicines Agency (EMA) plays a crucial role in ensuring drug safety and efficacy, which enhances consumer confidence and market growth. The region is witnessing a shift towards innovative therapies, supported by government initiatives aimed at fostering research and development. Leading countries such as Germany, France, and the UK are pivotal in this market, hosting numerous pharmaceutical giants like Roche and Novartis. The competitive landscape is marked by collaborations between academia and industry, enhancing the development of novel therapeutics. The presence of key players and a focus on regulatory compliance position Europe as a significant player in the global market.

Asia-Pacific : Rapid Growth and Development

The Asia-Pacific region, with a market size of 1.3B in 2025, is rapidly emerging as a key player in the pharmacokinetics pharmacodynamics landscape. Factors such as increasing healthcare expenditure, a growing population, and rising awareness of advanced therapies are driving market growth. Additionally, supportive government policies and investments in healthcare infrastructure are enhancing the region's capabilities in drug development and research. Countries like China, Japan, and India are leading the charge, with significant contributions from local and multinational companies. The competitive environment is characterized by a mix of established players and innovative startups, fostering a dynamic market. The presence of key players such as Gilead Sciences and AstraZeneca further strengthens the region's position in the global market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 0.15B in 2025, presents untapped opportunities in the pharmacokinetics pharmacodynamics sector. The growth is driven by increasing healthcare investments, rising disease prevalence, and a focus on improving healthcare access. Governments are implementing policies to enhance healthcare infrastructure, which is crucial for market development. Countries like South Africa and the UAE are at the forefront, with growing interest from international pharmaceutical companies. The competitive landscape is evolving, with local firms beginning to play a more significant role. The presence of key players and increasing collaborations are expected to drive growth in this region, making it a potential hotspot for future investments.