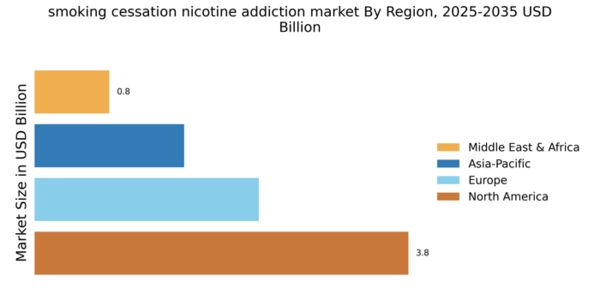

North America : Market Leader in Cessation

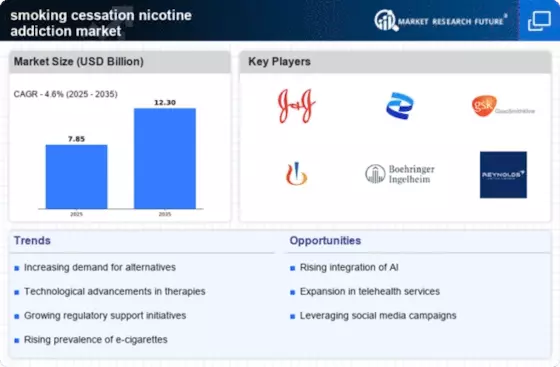

North America is the largest market for smoking cessation products, holding a significant share of 3.75 billion. The region's growth is driven by increasing health awareness, stringent regulations on tobacco use, and a robust healthcare infrastructure. Government initiatives aimed at reducing smoking rates, such as the CDC's campaigns, further catalyze demand for cessation aids. The rising prevalence of smoking-related diseases also propels consumers towards nicotine de-addiction solutions. The competitive landscape in North America is characterized by the presence of major players like Johnson & Johnson, Pfizer, and Altria Group. These companies are investing heavily in research and development to innovate new products, including nicotine replacement therapies and prescription medications. The U.S. market is particularly dynamic, with a growing trend towards personalized cessation programs and digital health solutions, enhancing the overall effectiveness of smoking cessation efforts.

Europe : Emerging Regulatory Frameworks

Europe's smoking cessation market is valued at 2.25 billion, driven by increasing regulatory measures aimed at reducing tobacco consumption. The European Union's Tobacco Products Directive mandates clear labeling and restricts advertising, creating a conducive environment for cessation products. Additionally, public health campaigns across member states are fostering a culture of smoking cessation, further boosting market demand. The region's focus on reducing smoking prevalence aligns with WHO guidelines, enhancing the market's growth potential. Leading countries in Europe include the UK, Germany, and France, where key players like GlaxoSmithKline and Novartis are actively engaged. The competitive landscape is evolving, with a mix of traditional pharmaceutical companies and emerging startups focusing on innovative cessation solutions. The presence of diverse product offerings, including e-cigarettes and behavioral therapies, is reshaping the market dynamics, catering to varying consumer preferences.

Asia-Pacific : Growing Awareness and Demand

The Asia-Pacific region, valued at 1.5 billion, is witnessing a surge in demand for smoking cessation products, driven by increasing health awareness and government initiatives. Countries like Australia and Japan are implementing strict regulations on tobacco sales and promoting cessation programs, which are significantly contributing to market growth. The rising incidence of smoking-related health issues is also pushing consumers towards seeking effective cessation solutions, creating a favorable market environment. In this region, key players such as Boehringer Ingelheim and Imperial Brands are expanding their presence, focusing on innovative products tailored to local preferences. The competitive landscape is characterized by a mix of multinational corporations and local firms, enhancing product availability. As the region continues to evolve, the integration of technology in cessation programs, such as mobile apps and online support, is expected to further drive market growth.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region, with a market size of 0.75 billion, presents significant growth opportunities in the smoking cessation sector. The increasing prevalence of smoking and related health issues is prompting governments to implement stricter regulations and public health campaigns aimed at reducing tobacco use. This regulatory push is expected to enhance the demand for cessation products, creating a more favorable market landscape. Additionally, rising disposable incomes are enabling consumers to invest in cessation aids, further driving market growth. Countries like South Africa and the UAE are leading the way in adopting cessation initiatives, with key players such as British American Tobacco and Reynolds American actively participating in the market. The competitive landscape is gradually evolving, with a focus on introducing innovative products and services tailored to local needs. As awareness of smoking-related health risks continues to grow, the market is poised for substantial expansion in the coming years.