Government Initiatives and Funding

The Japanese government has been proactive in enhancing the healthcare system, particularly in emergency medical services. Various initiatives have been launched to improve the quality and accessibility of emergency medical device services. For example, the government has allocated substantial funding to upgrade emergency medical facilities and procure advanced medical devices. In 2025, the budget for healthcare was increased by 8%, with a significant portion directed towards emergency services. This financial support is expected to bolster the Japan emergency medical device services market, as it enables healthcare providers to invest in state-of-the-art medical devices and training for emergency personnel. Such initiatives not only improve service delivery but also ensure that the healthcare system is better prepared for emergencies.

Rising Awareness of Health and Safety

There is a growing awareness among the Japanese population regarding health and safety, particularly in the context of emergency preparedness. This heightened awareness is influencing the Japan emergency medical device services market, as individuals and organizations are increasingly prioritizing access to emergency medical devices. Public campaigns and educational programs have been implemented to inform citizens about the importance of having emergency medical devices readily available. As a result, there is a noticeable increase in demand for personal emergency medical devices, such as automated external defibrillators (AEDs) and first aid kits. This trend suggests that the market will continue to expand as more individuals and businesses recognize the value of being prepared for medical emergencies.

Technological Innovations in Medical Devices

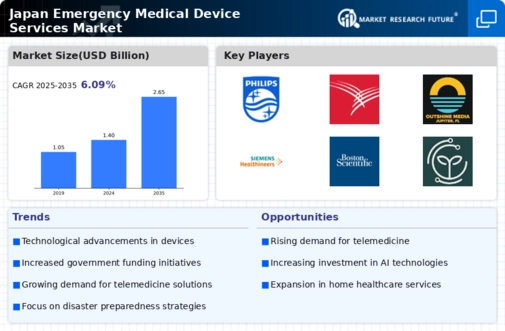

The Japan emergency medical device services market is witnessing a surge in technological innovations, particularly in the development of advanced medical devices. Innovations such as telemedicine, remote monitoring, and artificial intelligence are transforming the landscape of emergency medical services. For instance, the integration of AI in diagnostic tools has shown to improve response times and accuracy in emergency situations. According to recent data, the market for medical devices in Japan is projected to grow at a CAGR of 5.2% from 2021 to 2026, driven by these technological advancements. As hospitals and emergency services adopt these cutting-edge technologies, the demand for sophisticated medical devices is likely to increase, further propelling the growth of the emergency medical device services market.

Integration of Emergency Services with Healthcare Systems

The integration of emergency medical services with broader healthcare systems is becoming increasingly prevalent in Japan. This trend is likely to enhance the efficiency and effectiveness of emergency medical device services. By creating seamless connections between emergency services and hospitals, patient data can be shared in real-time, allowing for better decision-making during emergencies. The Japan emergency medical device services market stands to benefit from this integration, as it encourages the adoption of advanced medical devices that facilitate communication and data exchange. Moreover, this integration is supported by government policies aimed at improving healthcare delivery, which may lead to increased investments in emergency medical devices and services. As a result, the market is expected to grow as healthcare systems evolve to meet the demands of integrated emergency care.

Aging Population and Increased Demand for Emergency Services

Japan's demographic landscape is characterized by a rapidly aging population, which is projected to reach 36% of the total population by 2040. This demographic shift is likely to drive an increased demand for emergency medical device services, as older individuals typically require more medical attention and emergency interventions. The Japan emergency medical device services market is expected to expand significantly to accommodate this growing need. Furthermore, the government has been investing in healthcare infrastructure to ensure that emergency services are equipped with the latest medical devices, thereby enhancing the overall efficiency and effectiveness of emergency care. This trend suggests that the market will continue to grow as the population ages, necessitating advanced medical devices and services to meet the demands of an older demographic.