Government Initiatives and Policies

Government initiatives play a pivotal role in shaping the GCC emergency medical device services market. Various GCC nations have implemented policies aimed at improving healthcare delivery and emergency response systems. For instance, the Saudi Vision 2030 emphasizes the enhancement of healthcare services, including emergency medical care. Such initiatives often lead to increased funding and support for the procurement of advanced medical devices. Furthermore, regulatory frameworks are being established to ensure the quality and safety of emergency medical devices, thereby fostering a more robust market environment. These government efforts are likely to stimulate growth and innovation in the sector.

Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a critical driver of the GCC emergency medical device services market. Governments and private entities are allocating substantial resources to develop and upgrade healthcare facilities, including emergency departments. For instance, the UAE has announced plans to invest billions in healthcare infrastructure as part of its long-term strategy. This investment not only improves the physical infrastructure but also facilitates the acquisition of state-of-the-art emergency medical devices. As healthcare facilities become better equipped, the quality of emergency medical services is expected to improve, thereby fostering growth in the market.

Technological Innovations in Medical Devices

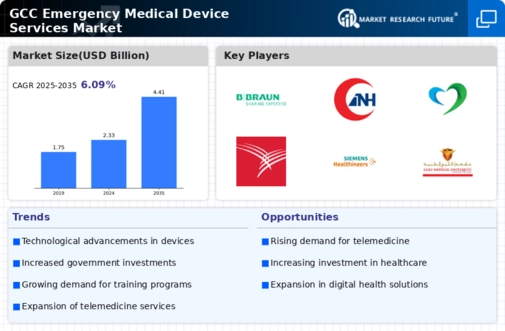

Technological advancements are significantly influencing the GCC emergency medical device services market. Innovations such as telemedicine, mobile health applications, and advanced diagnostic tools are transforming the way emergency medical services are delivered. For example, the integration of artificial intelligence in medical devices enhances decision-making processes during emergencies. The market for emergency medical devices is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next five years, driven by these technological innovations. As healthcare providers adopt these cutting-edge solutions, the overall efficiency and effectiveness of emergency medical services are expected to improve.

Growing Demand for Emergency Medical Services

The GCC emergency medical device services market is experiencing a notable increase in demand for emergency medical services. This surge is attributed to a rising population and urbanization, which necessitate efficient emergency response systems. According to recent statistics, the region's population is projected to reach over 60 million by 2030, leading to a higher incidence of medical emergencies. Consequently, healthcare providers are investing in advanced emergency medical devices to enhance their service capabilities. This growing demand is likely to drive innovation and competition within the market, as companies strive to meet the evolving needs of healthcare facilities and emergency responders.

Increased Public Awareness and Health Education

Public awareness regarding health issues and emergency preparedness is on the rise in the GCC region, positively impacting the emergency medical device services market. Educational campaigns and community programs are being implemented to inform citizens about the importance of timely medical intervention during emergencies. This heightened awareness is likely to lead to an increase in the utilization of emergency medical services, thereby driving demand for advanced medical devices. As more individuals recognize the value of immediate medical assistance, healthcare providers are compelled to enhance their service offerings, further stimulating growth in the market.