Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a vital driver for the India emergency medical device services market. The government and private sector are increasingly allocating funds to enhance healthcare facilities, particularly in emergency care. This includes the establishment of new hospitals, trauma centers, and emergency response units equipped with advanced medical devices. According to the Ministry of Health and Family Welfare, the healthcare expenditure in India is projected to reach 2.5% of GDP by 2025, which will likely lead to a surge in demand for emergency medical devices. Such investments not only improve service delivery but also create a conducive environment for the growth of the emergency medical device services market.

Government Initiatives and Policy Support

Government initiatives play a crucial role in shaping the India emergency medical device services market. The Indian government has implemented various policies aimed at enhancing healthcare infrastructure, including the National Health Mission and the Ayushman Bharat scheme. These initiatives are designed to improve access to emergency medical services across the country, particularly in rural areas. Furthermore, the government is actively promoting the Make in India campaign, which encourages domestic manufacturing of medical devices. This policy support is expected to bolster the local production of emergency medical devices, thereby reducing dependency on imports and fostering innovation within the industry.

Rising Incidence of Emergencies and Accidents

The rising incidence of emergencies and accidents in India is a significant driver for the emergency medical device services market. With urbanization and increased vehicular traffic, the number of road accidents and medical emergencies is on the rise. This trend necessitates the availability of efficient emergency medical services and advanced medical devices to respond promptly to such incidents. Data from the Ministry of Road Transport and Highways indicates that road accidents in India have increased by 1.5% annually, underscoring the urgent need for improved emergency response capabilities. Consequently, this growing demand for emergency medical services is likely to stimulate the market for emergency medical devices, as healthcare providers seek to enhance their response mechanisms.

Technological Advancements in Medical Devices

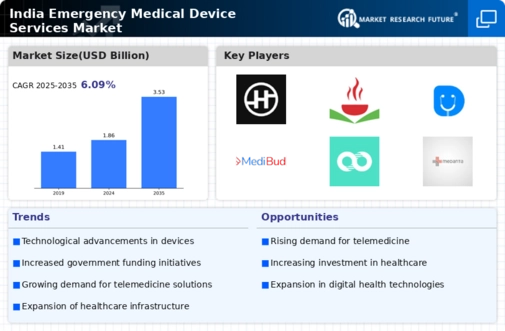

The rapid evolution of technology in the medical field is a pivotal driver for the India emergency medical device services market. Innovations such as telemedicine, portable diagnostic tools, and advanced life support systems are enhancing the efficiency and effectiveness of emergency medical services. For instance, the integration of artificial intelligence in diagnostic devices is streamlining patient assessment processes. According to recent data, the market for medical devices in India is projected to reach USD 50 billion by 2025, indicating a robust growth trajectory. This technological progress not only improves patient outcomes but also increases the demand for sophisticated emergency medical devices, thereby propelling the industry forward.

Growing Awareness and Demand for Emergency Services

There is a noticeable increase in public awareness regarding the importance of emergency medical services in India, which is significantly influencing the emergency medical device services market. As citizens become more informed about health issues and the critical nature of timely medical intervention, the demand for emergency services is rising. This trend is reflected in the increasing number of emergency calls and the establishment of dedicated emergency response units across urban and rural areas. Market data suggests that the demand for emergency medical devices is expected to grow at a CAGR of 15% over the next five years, driven by this heightened awareness and the need for rapid response capabilities.