Innovations in Product Formulation

Innovations in product formulation are playing a pivotal role in shaping the dietary supplements market in Japan. Companies are increasingly focusing on developing unique and effective formulations that cater to specific health concerns. For instance, the introduction of functional foods and supplements that combine traditional ingredients with modern science is gaining traction. This trend is supported by consumer demand for products that offer enhanced benefits, such as improved absorption and targeted health effects. The dietary supplements market is witnessing a rise in products that utilize advanced technologies, such as microencapsulation and fermentation, to improve efficacy. As research continues to unveil new health benefits associated with various ingredients, the market is likely to see a proliferation of innovative products that appeal to health-conscious consumers.

E-commerce Growth and Accessibility

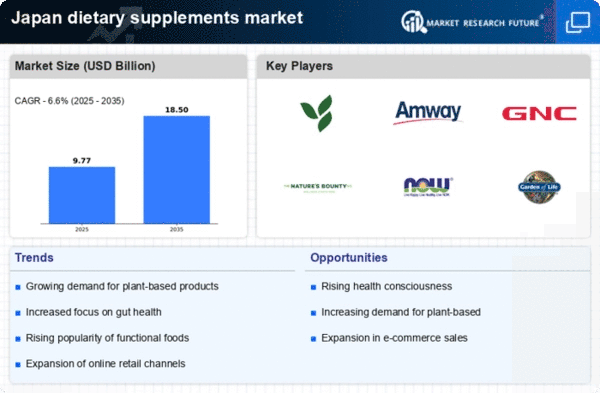

The rise of e-commerce in Japan is transforming the dietary supplements market by enhancing accessibility for consumers. Online sales channels have become increasingly popular, with a reported growth rate of 15% in the e-commerce sector for health products. This shift allows consumers to conveniently purchase dietary supplements from the comfort of their homes, expanding the market reach for various brands. Additionally, e-commerce platforms often provide detailed product information and customer reviews, which can influence purchasing decisions. As a result, companies are investing in digital marketing strategies to capture the attention of online shoppers. The dietary supplements market is likely to benefit from this trend, as more consumers turn to online platforms for their health and wellness needs, thereby driving sales and fostering competition among brands.

Aging Population and Nutritional Needs

The aging population in Japan is a crucial driver for the dietary supplements market. As the demographic shifts towards an older age group, there is an increasing demand for products that support health and longevity. Approximately 28% of the population is aged 65 and older, leading to a heightened focus on nutritional needs that can mitigate age-related health issues. This demographic is particularly interested in supplements that promote joint health, cognitive function, and overall vitality. The dietary supplements market is likely to see a surge in products tailored to this segment, as older consumers seek to maintain their quality of life through preventive health measures. Consequently, companies are innovating to create formulations that cater specifically to the nutritional requirements of seniors, thereby expanding their market reach and enhancing product offerings.

Regulatory Support and Quality Assurance

Regulatory support and quality assurance are essential drivers for the dietary supplements market in Japan. The government has established stringent regulations to ensure the safety and efficacy of dietary supplements, which fosters consumer trust. This regulatory framework encourages companies to adhere to high standards of quality, thereby enhancing the overall credibility of the market. As a result, consumers are more likely to purchase products that are certified and comply with regulatory guidelines. The dietary supplements market benefits from this environment, as it promotes transparency and accountability among manufacturers. Furthermore, ongoing government initiatives aimed at educating consumers about dietary supplements contribute to informed purchasing decisions, potentially leading to increased market growth. Companies that prioritize compliance and quality assurance are likely to gain a competitive edge in this evolving landscape.

Rising Health Consciousness Among Consumers

In Japan, there is a notable increase in health consciousness among consumers, which significantly impacts the dietary supplements market. This trend is reflected in the growing preference for products that enhance overall well-being and prevent chronic diseases. Surveys indicate that over 60% of Japanese consumers actively seek out dietary supplements to complement their diets and improve their health. This shift towards proactive health management is driving demand for a variety of supplements, including vitamins, minerals, and herbal products. As consumers become more informed about nutrition and wellness, the dietary supplements market is likely to expand, with companies focusing on transparency and quality in their product offerings. This heightened awareness presents opportunities for brands to educate consumers about the benefits of their products, potentially leading to increased sales and market growth.