Increased Public Health Awareness

The covid 19-diagnostics market in Italy experiences a notable boost due to heightened public health awareness. The population's understanding of the importance of early detection and testing has surged, particularly in light of previous health crises. This awareness translates into increased demand for diagnostic tests, as individuals seek to ensure their health and the safety of their communities. According to recent data, the market is projected to grow by approximately 15% annually, driven by this proactive approach to health management. Furthermore, public health campaigns and educational initiatives have played a crucial role in informing citizens about the availability and necessity of testing, thereby fostering a culture of preventive healthcare. This trend is likely to continue, as ongoing education and awareness efforts solidify the importance of diagnostics in managing public health.

Government Initiatives and Funding

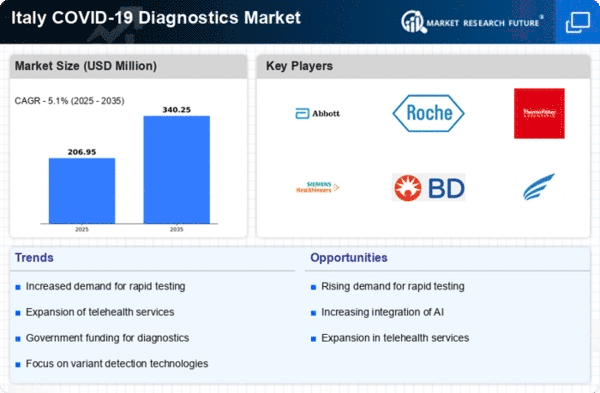

Government initiatives in Italy significantly influence the covid 19-diagnostics market. The Italian government has allocated substantial funding to enhance testing capabilities and improve healthcare infrastructure. This financial support is aimed at increasing the availability of diagnostic tests across various regions, particularly in underserved areas. Recent reports indicate that government spending on health-related initiatives has risen by 20%, with a significant portion directed towards diagnostic technologies. Such investments not only facilitate the development of innovative testing solutions but also ensure that the population has access to necessary diagnostic services. As a result, the market is likely to see sustained growth, driven by these strategic government interventions that prioritize public health and safety.

Impact of Variants on Testing Needs

The emergence of new variants of the virus has a profound impact on the covid 19-diagnostics market. In Italy, the ongoing evolution of the virus necessitates continuous adaptation of testing strategies to ensure effectiveness. As variants emerge, there is a growing need for diagnostic tests that can accurately identify these mutations. This has led to increased research and development efforts aimed at creating tests that are not only effective against existing strains but also adaptable to future variants. The market is likely to see a rise in demand for such advanced testing solutions, as healthcare providers and the public seek assurance that diagnostic tools remain relevant. This dynamic environment suggests that the market could expand by approximately 15% as new testing solutions are developed to meet the challenges posed by evolving variants.

Rising Demand for Home Testing Solutions

The covid 19-diagnostics market is experiencing a shift towards home testing solutions, reflecting changing consumer preferences in Italy. The convenience and privacy associated with at-home testing kits have led to a surge in demand, particularly among individuals seeking to avoid crowded testing facilities. Recent surveys indicate that approximately 30% of the population prefers home testing options, which has prompted manufacturers to innovate and expand their product offerings. This trend is likely to reshape the market landscape, as companies invest in developing reliable and easy-to-use home testing kits. The potential for this segment to grow is substantial, with projections suggesting a 25% increase in sales of home testing solutions over the next few years, driven by consumer demand for accessible and efficient diagnostic options.

Technological Advancements in Diagnostics

Technological advancements play a pivotal role in shaping the covid 19-diagnostics market. Innovations in testing methodologies, such as the development of PCR and antigen tests, have enhanced the accuracy and speed of diagnostics. In Italy, the integration of advanced technologies has led to a reduction in testing turnaround times, with some tests providing results in under an hour. This rapid response capability is crucial in managing outbreaks and ensuring timely interventions. Furthermore, the market is witnessing a shift towards more user-friendly testing solutions, including at-home testing kits, which cater to the growing demand for convenience. As these technologies continue to evolve, they are expected to drive market growth, potentially increasing the market size by 10% over the next few years.