Government Funding and Support

Government funding significantly influences the covid 19-diagnostics market in Germany. In response to the ongoing health crisis, the German government has allocated substantial financial resources to support research and development in diagnostic technologies. As of November 2025, this funding is estimated to exceed €500 million, aimed at fostering innovation and ensuring the availability of high-quality diagnostic solutions. This financial backing not only encourages local manufacturers to enhance their product offerings but also attracts international players to invest in the German market. Consequently, this influx of capital is likely to stimulate growth and improve the overall landscape of the covid 19-diagnostics market.

Increased Demand for Testing Kits

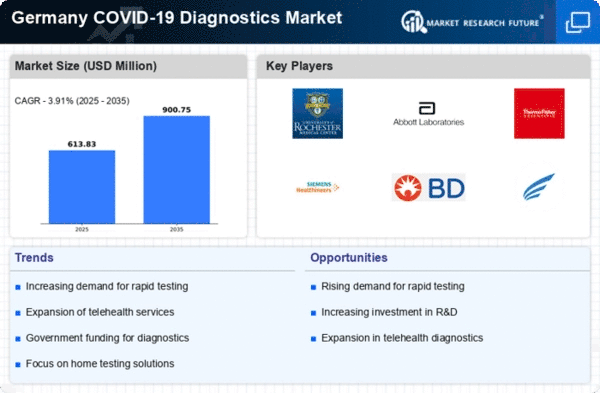

The covid 19-diagnostics market in Germany experiences heightened demand for testing kits, driven by ongoing public health initiatives and the need for rapid identification of cases. As of November 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the urgency for effective diagnostic solutions. The German government has implemented various programs to ensure widespread access to testing, which has led to a significant increase in the availability of both PCR and antigen tests. This demand is further fueled by the necessity for regular testing in schools, workplaces, and public events, thereby reinforcing the importance of reliable diagnostic tools in managing public health.

Public Awareness and Education Campaigns

Public awareness initiatives are pivotal in driving the covid 19-diagnostics market in Germany. As the population becomes more informed about the importance of early detection and testing, the demand for diagnostic services is expected to rise. Campaigns aimed at educating citizens about the benefits of regular testing and the availability of various diagnostic options are currently being implemented. These efforts are likely to increase testing rates, thereby enhancing the overall effectiveness of public health strategies. As of November 2025, it appears that such educational programs could lead to a 15% increase in testing participation, further solidifying the role of diagnostics in managing health crises.

Technological Advancements in Diagnostics

Technological innovations play a crucial role in shaping the covid 19-diagnostics market in Germany. The introduction of advanced molecular techniques, such as CRISPR-based diagnostics, has the potential to enhance the accuracy and speed of testing. As of November 2025, the market is witnessing a shift towards more sophisticated testing methods that can deliver results within hours. These advancements not only improve patient outcomes but also streamline the testing process, making it more efficient. Furthermore, the integration of artificial intelligence in diagnostic tools is likely to optimize data analysis, thereby increasing the overall effectiveness of the covid 19-diagnostics market.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a key driver in the covid 19-diagnostics market in Germany. Partnerships between government agencies and private companies facilitate the rapid development and distribution of diagnostic tests. As of November 2025, several initiatives are underway that leverage the strengths of both sectors to enhance testing capabilities. This collaborative approach not only accelerates innovation but also ensures that diagnostic solutions are accessible to a broader population. The synergy between public health objectives and private sector efficiency is likely to create a more resilient and responsive covid 19-diagnostics market.