Emergence of New Variants

The emergence of new variants of the virus continues to influence the covid 19-diagnostics market. As variants evolve, the need for effective diagnostic tools that can accurately detect these changes becomes increasingly critical. The US has witnessed several variants that have demonstrated varying degrees of transmissibility and resistance to existing tests. This dynamic landscape necessitates the development of updated diagnostic solutions, which could lead to a market expansion. Analysts suggest that the market may grow by approximately 10% annually as manufacturers adapt their products to meet the challenges posed by new variants, ensuring that testing remains effective and reliable.

Public Awareness and Education

Public awareness regarding the importance of testing has significantly impacted the covid 19-diagnostics market. Educational campaigns aimed at informing the population about the benefits of regular testing have led to increased participation in testing programs. In the US, surveys indicate that over 70% of individuals recognize the importance of testing in controlling the spread of the virus. This heightened awareness has resulted in a greater demand for diagnostic services, particularly in community settings. Consequently, the market is likely to experience growth as more individuals seek testing, driven by a better understanding of its role in public health.

Government Initiatives and Funding

Government initiatives play a pivotal role in shaping the covid 19-diagnostics market. In the US, substantial funding has been allocated to enhance testing capabilities and improve access to diagnostics. Programs aimed at increasing testing availability in underserved communities have emerged, reflecting a commitment to equitable healthcare. The federal government has invested over $10 billion in testing infrastructure, which has bolstered the market's growth. These initiatives not only support the development of innovative diagnostic technologies but also ensure that testing remains accessible to the population. As a result, the market is likely to see sustained growth driven by ongoing government support.

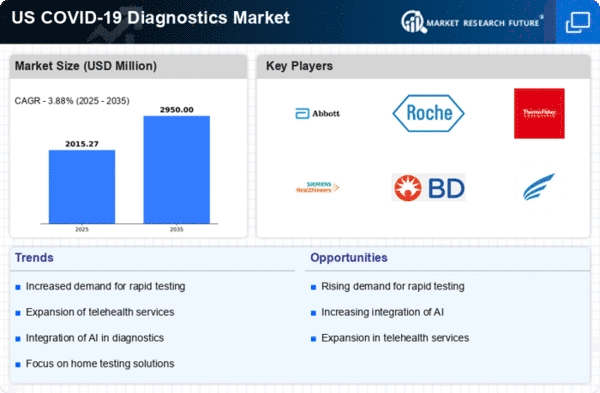

Increased Demand for Rapid Testing

The COVID-19 diagnostics market experiences heightened demand for rapid testing solutions, driven by the need for quick results in various settings, including hospitals, clinics, and workplaces. Rapid tests enable timely decision-making, which is crucial for controlling outbreaks. In the US, the market for rapid antigen tests has surged, with estimates indicating that these tests account for a substantial portion of the overall diagnostics market. The convenience and speed of these tests appeal to both healthcare providers and patients, leading to a projected growth rate of approximately 15% annually in this segment. This trend underscores the importance of rapid testing in the ongoing management of public health and safety.

Technological Advancements in Diagnostics

Technological advancements are reshaping the covid 19-diagnostics market, with innovations enhancing the accuracy and efficiency of testing methods. The integration of artificial intelligence and machine learning in diagnostic processes is becoming more prevalent, allowing for faster analysis and improved result interpretation. In the US, companies are investing heavily in research and development to create next-generation diagnostic tools that can provide real-time results. This trend is expected to drive market growth, with projections indicating a potential increase of 12% annually as new technologies are adopted. The continuous evolution of diagnostic capabilities is crucial for addressing the ongoing challenges posed by the pandemic.