COVID 19 Diagnostics Market Summary

As per Market Research Future analysis, the COVID-19 Diagnostics Market was estimated at 7.876 USD Billion in 2024. The COVID-19 Diagnostics industry is projected to grow from 8.184 USD Billion in 2025 to 12.01 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.91% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The COVID-19 Diagnostics Market is experiencing dynamic growth driven by technological advancements and evolving healthcare needs.

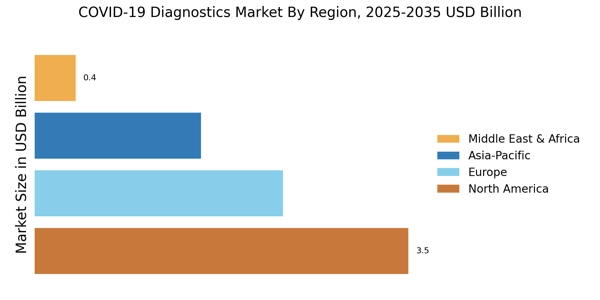

- The rise of point-of-care testing is transforming the landscape of COVID-19 diagnostics, particularly in North America.

- Integration of advanced technologies is enhancing the accuracy and speed of PCR tests, which remain the largest segment.

- In Asia-Pacific, the antigen tests segment is witnessing rapid growth, reflecting a shift towards more accessible testing options.

- Increased demand for rapid testing solutions and government initiatives are key drivers propelling market expansion across both hospital and home care settings.

Market Size & Forecast

| 2024 Market Size | 7.876 (USD Billion) |

| 2035 Market Size | 12.01 (USD Billion) |

| CAGR (2025 - 2035) | 3.91% |

Major Players

Abbott Laboratories (US), Roche Diagnostics (CH), Thermo Fisher Scientific (US), Siemens Healthineers (DE), BD (US), Cepheid (US), Hologic (US), PerkinElmer (US), Bio-Rad Laboratories (US)