Expansion in Emerging Markets

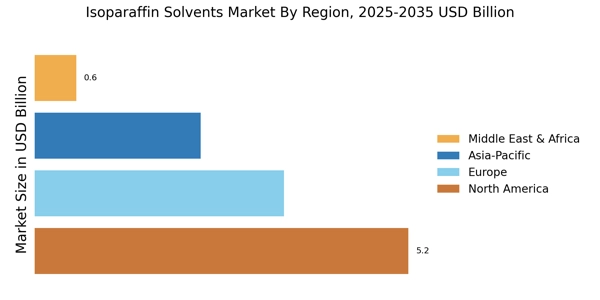

The Isoparaffin Solvents Market is witnessing significant growth opportunities in emerging markets. As industrialization accelerates in regions such as Asia-Pacific and Latin America, the demand for isoparaffin solvents is expected to rise substantially. These regions are experiencing a surge in manufacturing activities, particularly in sectors like automotive, construction, and consumer goods, which utilize isoparaffin solvents for various applications. Market data indicates that the Asia-Pacific region alone is projected to account for a considerable share of The Isoparaffin Solvents Market by 2026. This expansion is likely to be driven by increasing investments in infrastructure and a growing middle-class population, which collectively contribute to heightened demand for solvent-based products.

Regulatory Support for Safer Chemicals

The Isoparaffin Solvents Market benefits from increasing regulatory support aimed at promoting safer chemical alternatives. Governments and regulatory bodies are implementing stringent regulations to limit the use of hazardous solvents, thereby encouraging the adoption of isoparaffin solvents, which are recognized for their lower environmental impact. This regulatory landscape is fostering a shift towards safer chemical practices, which is likely to enhance the market's growth. For instance, the implementation of regulations such as REACH in Europe has led to a greater emphasis on the safety and sustainability of chemical products. Consequently, manufacturers are increasingly investing in the development of isoparaffin solvents that comply with these regulations, further propelling market expansion.

Increasing Use in Specialty Applications

The Isoparaffin Solvents Market is experiencing a notable shift towards the use of isoparaffin solvents in specialty applications. These solvents are increasingly being utilized in niche markets such as pharmaceuticals, agrochemicals, and electronics, where their unique properties are highly valued. For instance, in the pharmaceutical sector, isoparaffin solvents are favored for their purity and low odor, making them suitable for drug formulation. Market analysis suggests that the specialty chemicals segment, which includes isoparaffin solvents, is projected to grow at a CAGR of approximately 5% over the next few years. This trend indicates a growing recognition of the versatility and effectiveness of isoparaffin solvents in specialized applications, further driving the market's expansion.

Rising Demand for Solvent-Based Products

The Isoparaffin Solvents Market is experiencing a notable increase in demand for solvent-based products across various sectors. Industries such as paints and coatings, adhesives, and personal care are increasingly utilizing isoparaffin solvents due to their favorable properties, including low toxicity and high solvency. This trend is further supported by the growing consumer preference for products that are less harmful to health and the environment. As a result, the market for isoparaffin solvents is projected to expand, with estimates suggesting a compound annual growth rate (CAGR) of around 4% over the next few years. This rising demand is likely to drive innovation and investment in the production of isoparaffin solvents, thereby enhancing their availability and application versatility.

Technological Innovations in Production Processes

Technological advancements in the production processes of isoparaffin solvents are playing a crucial role in shaping the Isoparaffin Solvents Market. Innovations such as improved refining techniques and the development of more efficient catalytic processes are enhancing the yield and quality of isoparaffin solvents. These advancements not only reduce production costs but also minimize environmental impact, aligning with the industry's shift towards sustainability. Furthermore, the integration of automation and digital technologies in manufacturing processes is likely to streamline operations, thereby increasing overall efficiency. As a result, manufacturers are better positioned to meet the growing demand for high-quality isoparaffin solvents, which is expected to bolster market growth in the coming years.