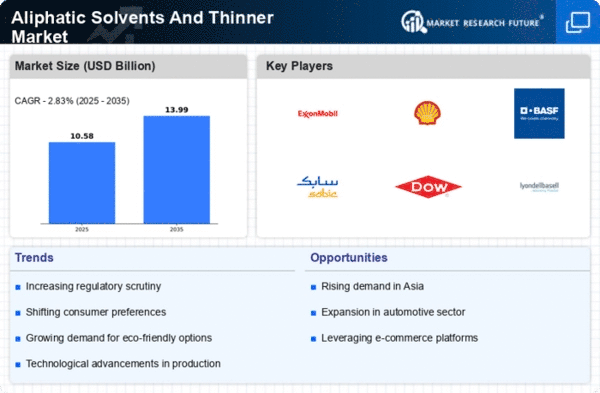

Market Growth Projections

The Global Aliphatic Solvents and Thinners Market Industry is projected to experience substantial growth, with a market value expected to reach 14.0 USD Billion by 2035. The anticipated CAGR of 2.83% from 2025 to 2035 indicates a steady increase in demand driven by various factors, including the expansion of end-use industries and the ongoing shift towards sustainable solutions. This growth trajectory suggests a positive outlook for manufacturers and stakeholders within the industry, as they adapt to changing market dynamics and consumer preferences.

Expansion of the Automotive Sector

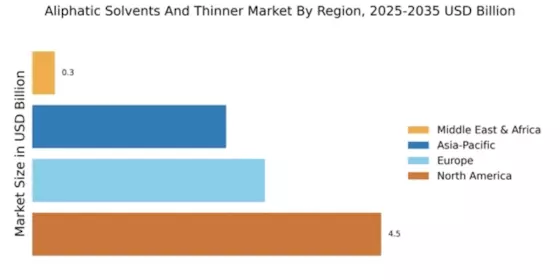

The automotive industry significantly influences the Global Aliphatic Solvents and Thinners Market Industry, as these solvents are essential for automotive paints and coatings. With the automotive sector projected to grow steadily, the demand for aliphatic solvents is likely to increase. The need for high-performance coatings that provide durability and aesthetic appeal drives this trend. As manufacturers seek to improve vehicle longevity and appearance, the market for aliphatic solvents is expected to expand, contributing to the overall market value, which is anticipated to reach 14.0 USD Billion by 2035.

Growing Demand in Paints and Coatings

The Global Aliphatic Solvents and Thinners Market Industry experiences a robust demand from the paints and coatings sector, which is projected to reach a value of 10.3 USD Billion in 2024. This growth is driven by the increasing need for high-quality finishes in residential and commercial construction. Aliphatic solvents are favored for their low toxicity and effective performance in thinning paints, thus enhancing application properties. As the construction industry expands globally, the demand for these solvents is expected to rise, indicating a strong correlation between construction activities and solvent consumption.

Diverse Applications Across Industries

The versatility of aliphatic solvents is a key driver for the Global Aliphatic Solvents and Thinners Market Industry, as they find applications in various sectors, including pharmaceuticals, cosmetics, and cleaning products. This broad applicability ensures a steady demand across multiple industries, which is crucial for market stability. As industries continue to evolve and innovate, the need for effective solvents that can meet specific application requirements is likely to grow. This diverse utilization not only supports market expansion but also encourages the development of specialized formulations tailored to different industrial needs.

Technological Advancements in Production

Technological innovations in the production of aliphatic solvents are enhancing efficiency and reducing costs within the Global Aliphatic Solvents and Thinners Market Industry. Advanced manufacturing processes, such as continuous production techniques and improved separation technologies, allow for higher purity and better performance of solvents. These advancements not only improve product quality but also enable manufacturers to meet the increasing demand from various sectors, including paints, coatings, and adhesives. As production capabilities expand, the market is expected to grow at a CAGR of 2.83% from 2025 to 2035, reflecting the positive impact of technology on market dynamics.

Regulatory Compliance and Eco-Friendly Solutions

Increasing regulatory pressures regarding environmental sustainability are shaping the Global Aliphatic Solvents and Thinners Market Industry. Governments worldwide are implementing stringent regulations on volatile organic compounds (VOCs) in solvents, prompting manufacturers to innovate and develop eco-friendly alternatives. This shift towards sustainable practices not only aligns with regulatory requirements but also meets consumer preferences for greener products. As a result, the market is likely to witness a transition towards low-VOC and bio-based solvents, which could enhance market growth and appeal to environmentally conscious consumers.