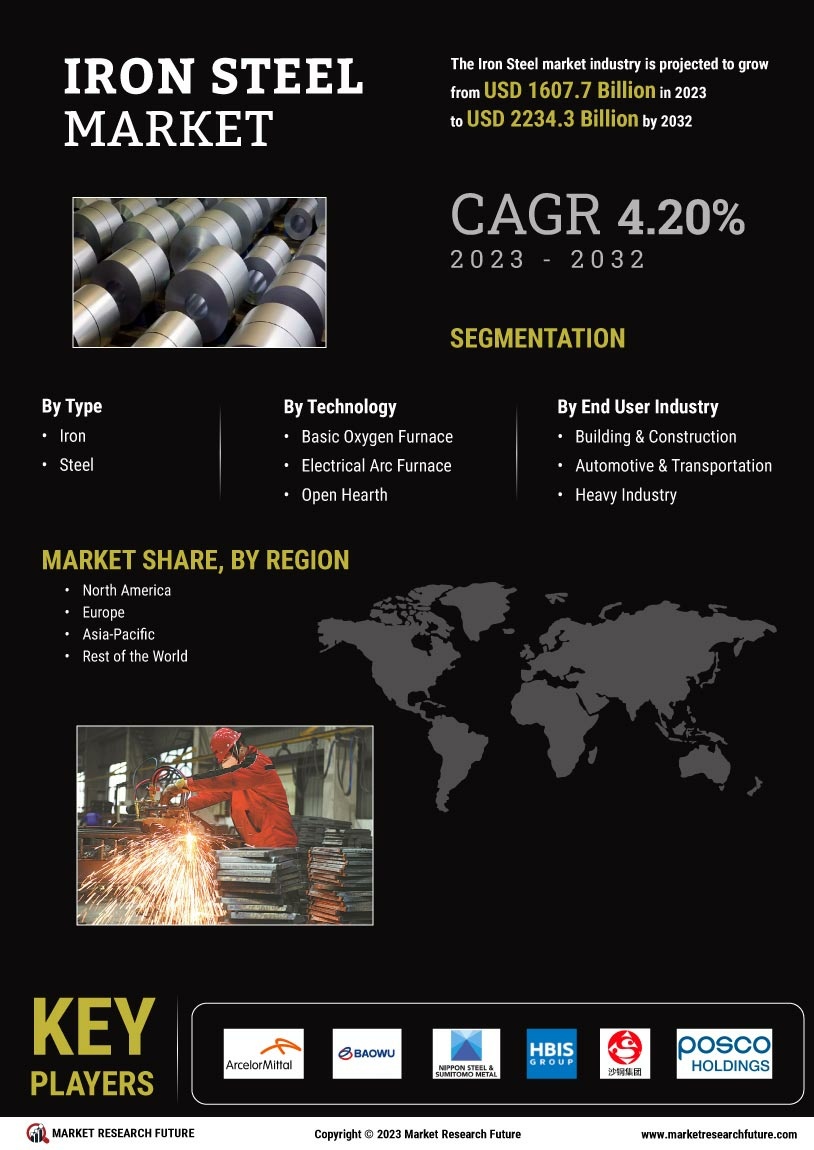

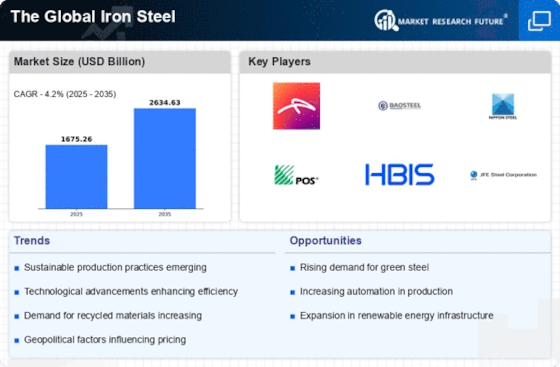

Energy Sector Demand

The energy sector, particularly renewable energy, is emerging as a significant driver for the iron steel market. The construction of wind turbines, solar panels, and other renewable energy infrastructures requires substantial amounts of steel. It is estimated that the renewable energy sector could account for around 10% of global steel demand by 2025. This shift towards sustainable energy solutions is likely to bolster The Global Iron Steel Industry, as companies adapt to meet the needs of this evolving landscape. Moreover, the transition from fossil fuels to renewable sources may lead to increased investments in energy infrastructure, further enhancing steel consumption in the sector.

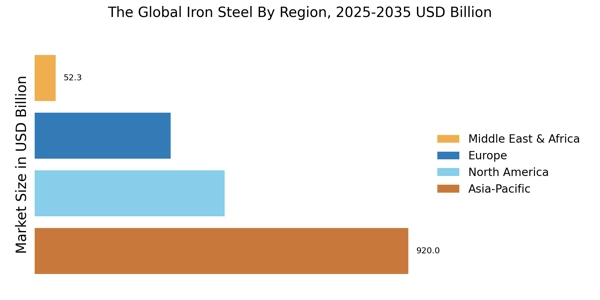

Global Trade Dynamics

The dynamics of The Global Iron Steel Market in various ways. Tariffs, trade agreements, and geopolitical tensions can significantly impact steel prices and availability. For instance, fluctuations in trade policies may lead to increased costs for imported steel, thereby affecting domestic markets. The Global Iron Steel Industry must navigate these complexities, as changes in trade dynamics can create both challenges and opportunities. Countries that adapt to these shifts may find new markets for their steel products, while others may face increased competition. This evolving landscape necessitates strategic planning and adaptability among industry players.

Technological Innovations

Technological advancements in steel production and processing are likely to reshape the iron steel market. Innovations such as electric arc furnaces and advanced metallurgy techniques are enhancing production efficiency and reducing environmental impact. These developments may lead to a more sustainable production process, which is increasingly demanded by consumers and regulators alike. The Global Iron Steel Industry is expected to benefit from these innovations, as they allow for the production of higher-quality steel at lower costs. Furthermore, the integration of automation and digital technologies in manufacturing processes could streamline operations, potentially increasing output and profitability for steel producers.

Automotive Industry Growth

The automotive sector is experiencing a resurgence, which significantly influences the iron steel market. As vehicle production ramps up, the demand for high-strength steel is likely to increase, driven by the need for lightweight materials that enhance fuel efficiency. In recent years, the automotive industry has accounted for nearly 12% of global steel consumption, a figure that may rise as electric vehicles gain traction. The Global Iron Steel Industry stands to gain from this trend, as manufacturers seek to innovate and produce vehicles that meet stringent environmental regulations. Additionally, the shift towards electric vehicles may necessitate new steel formulations, further driving research and development within the sector.

Infrastructure Development

The ongoing expansion of infrastructure projects worldwide appears to be a primary driver for the iron steel market. Governments are investing heavily in transportation networks, bridges, and urban development, which necessitates substantial quantities of steel. For instance, the construction sector is projected to consume approximately 50% of the total steel production, indicating a robust demand. This trend is likely to continue as nations prioritize infrastructure to stimulate economic growth. The Global Iron Steel Industry is thus poised to benefit from these investments, as the need for durable materials remains paramount. Furthermore, the rise in urbanization is expected to further amplify the demand for steel, as cities expand and require more robust infrastructure to support growing populations.