Top Industry Leaders in the Iron Steel Market

The iron & steel market pulsates with dynamic competition. Understanding this landscape is crucial for navigating its complexities. In this report, we delve into the market's competitive strategies, key players, industry news.

The iron & steel market pulsates with dynamic competition. Understanding this landscape is crucial for navigating its complexities. In this report, we delve into the market's competitive strategies, key players, industry news.

Market Share Drivers:

-

Production Capacity and Cost Efficiency: Leading players like China Baowu Steel Group and ArcelorMittal boast massive production capacities, allowing them to achieve economies of scale and cost leadership. -

Product Portfolio and Innovation: Diversifying product offerings across various steel grades and investing in R&D for advanced high-strength steels (AHSS) give companies a competitive edge. -

Geographic Reach and Distribution Network: Strong presence in key demand regions and efficient logistics networks ensure timely deliveries and market access. -

Sustainability Initiatives: Companies adopting green steel production practices and reducing carbon emissions attract environmentally conscious customers.

Competitive Strategies:

-

Mergers & Acquisitions: Consolidation is a prevalent trend, with players like POSCO and Nippon Steel merging their European operations to optimize resources. -

Vertical Integration: Integrating upstream (iron ore mining) and downstream (steel fabrication) operations secures raw material supply and value chain control. -

Technological Advancements: Investments in automation, artificial intelligence, and digitalization improve production efficiency and yield optimization. -

Market Expansion: Targeting emerging markets with growing infrastructure and construction needs presents lucrative opportunities.

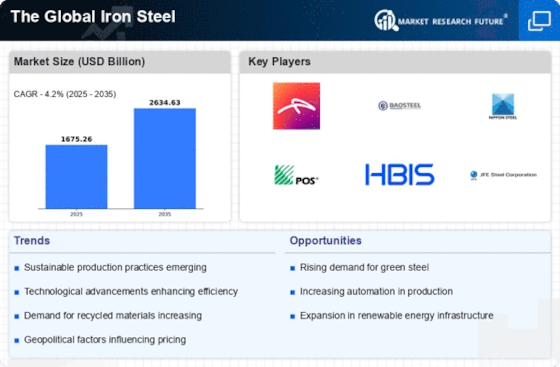

Key Players

- ArcelorMittal

- China BaoWu Steel Group Corporation Limited

- Nippon Steel Corporation

- HBIS Group

- Jiangsu Shagang Group

- POSCO HOLDINGS INC.

- Tata Steel

- JFE Steel Corporation

- Shougang Group

- Nucor Corporation

- JSW

- SAIL

- NLMK

- Techint Group

- S. Steel Corporation

Recent Developments :

October 2023: Baowu Steel and HBIS Group announce plans for a joint venture to develop green steel technologies.

November 2023: ArcelorMittal invests in hydrogen-based steelmaking pilot project to reduce carbon footprint.

December 2023: Nippon Steel and POSCO launch joint research center for advanced steel materials.