Energy Sector Demand

The energy sector, particularly renewable energy, is emerging as a vital driver for the Iron And Steel Casting Market. The transition towards sustainable energy sources, such as wind and solar, necessitates the use of durable castings for turbines and other equipment. In 2025, the demand for iron and steel castings in the energy sector is anticipated to grow, with projections suggesting an increase of around 4% annually. This trend indicates a shift in focus towards more sustainable practices, which could lead to a higher demand for castings that meet stringent environmental standards. As the energy landscape evolves, the iron and steel casting market is likely to benefit from this growing sector.

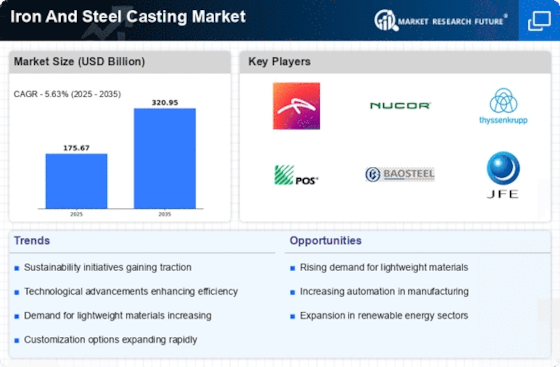

Technological Innovations

Technological advancements in casting processes and materials are likely to play a crucial role in shaping the Iron And Steel Casting Market. Innovations such as 3D printing and automated casting techniques are enhancing production efficiency and reducing costs. In 2025, the adoption of these technologies is expected to increase, potentially leading to a market growth rate of around 6%. This shift towards more efficient manufacturing processes may enable companies to produce higher-quality castings with improved precision and reduced waste. As the industry embraces these innovations, the iron and steel casting market is likely to experience a transformation that could redefine production standards and capabilities.

Automotive Industry Growth

The automotive sector's resurgence is likely to have a profound impact on the Iron And Steel Casting Market. As vehicle production ramps up, the need for high-quality castings for engine components, chassis, and other critical parts is expected to increase. In 2025, the automotive industry is projected to consume a substantial share of iron and steel castings, with estimates indicating a market size of over 20 billion USD. This growth is driven by the rising demand for electric vehicles, which require specialized castings for battery housings and other components. Consequently, the automotive industry's evolution is poised to be a significant catalyst for the iron and steel casting market.

Infrastructure Development

The ongoing expansion of infrastructure projects worldwide appears to be a primary driver for the Iron And Steel Casting Market. Governments and private sectors are investing heavily in roads, bridges, and buildings, which necessitate the use of iron and steel castings for structural integrity. In 2025, the demand for castings in construction is projected to rise significantly, with estimates suggesting a growth rate of approximately 5% annually. This trend indicates a robust market for iron and steel castings, as they are essential components in various construction applications. Furthermore, the increasing urbanization and population growth are likely to further fuel this demand, making infrastructure development a critical factor in the industry's expansion.

Aerospace Industry Expansion

The aerospace industry is experiencing notable growth, which is likely to influence the Iron And Steel Casting Market positively. As air travel demand increases, manufacturers require high-performance castings for aircraft components, including engine parts and structural elements. In 2025, the aerospace sector is expected to account for a significant portion of the iron and steel casting market, with estimates suggesting a market value exceeding 15 billion USD. This growth is driven by advancements in technology and materials, which necessitate the use of specialized castings that can withstand extreme conditions. Thus, the aerospace industry's expansion is poised to be a key driver for the iron and steel casting market.