North America : Investment Powerhouse

North America dominates the Investment Advisory and Wealth Management Services Market, holding a significant market share of 75.0 in 2024. The region's growth is driven by a robust economy, increasing high-net-worth individuals (HNWIs), and a growing demand for personalized financial services. Regulatory frameworks are also evolving to support innovation and transparency, enhancing investor confidence and market participation.

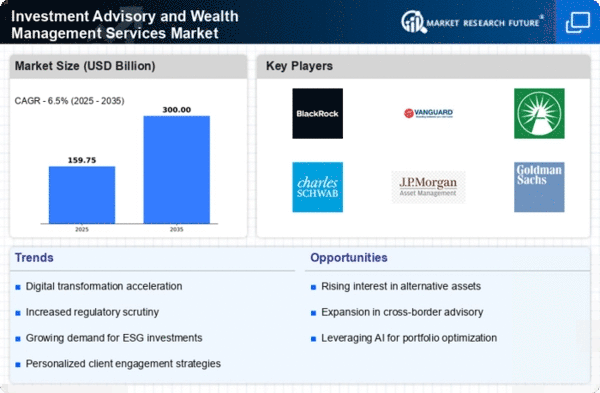

The competitive landscape is characterized by major players such as BlackRock, Vanguard Group, and Fidelity Investments, which are leading the charge in asset management and advisory services. The U.S. remains the largest market, with Canada and Mexico also contributing to growth. The presence of established financial institutions and a strong regulatory environment further solidify North America's position as a leader in wealth management services.

Europe : Diverse Investment Landscape

Europe's Investment Advisory and Wealth Management Services Market is valued at 40.0, reflecting a growing demand for tailored financial solutions. Key growth drivers include an increasing number of affluent individuals, regulatory support for financial innovation, and a shift towards sustainable investing. The region is also witnessing a rise in digital platforms that enhance accessibility and client engagement, contributing to market expansion.

Leading countries such as the UK, Germany, and France are at the forefront of this growth, with firms like UBS Group and BNP Paribas playing pivotal roles. The competitive landscape is marked by a mix of traditional banks and fintech companies, fostering innovation and improving service delivery. As regulations evolve, firms are adapting to meet new compliance standards, ensuring a robust and dynamic market environment.

Asia-Pacific : Emerging Wealth Management Hub

The Asia-Pacific region, with a market size of 30.0, is rapidly emerging as a key player in the Investment Advisory and Wealth Management Services Market. The growth is fueled by rising disposable incomes, an expanding middle class, and increasing financial literacy among consumers. Regulatory bodies are also promoting investment through favorable policies, which are attracting both domestic and foreign investments into the market.

Countries like China, Japan, and Australia are leading the charge, with a growing number of local and international firms entering the market. The competitive landscape is diverse, featuring both established players and innovative startups. As the region continues to develop, the demand for personalized and technology-driven financial services is expected to rise, further enhancing market dynamics.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region, with a market size of 5.0, is gradually emerging in the Investment Advisory and Wealth Management Services Market. Key growth drivers include increasing wealth among HNWIs, a growing interest in investment diversification, and supportive regulatory frameworks aimed at attracting foreign investments. The region is also witnessing a rise in financial literacy, which is fostering demand for advisory services.

Leading countries such as the UAE and South Africa are at the forefront of this growth, with local firms and international players expanding their presence. The competitive landscape is evolving, with a mix of traditional banks and new fintech entrants. As the market matures, the focus on innovative financial solutions and client-centric services is expected to drive further growth.