North America : Market Leader in Wealth Services

North America continues to lead the Wealth Preservation and Legacy Planning Services Market, holding a significant market share of 2.75B in 2024. The region's growth is driven by increasing high-net-worth individuals (HNWIs) and a rising demand for personalized financial planning services. Regulatory frameworks are also evolving, encouraging transparency and consumer protection, which further boosts market confidence and participation.

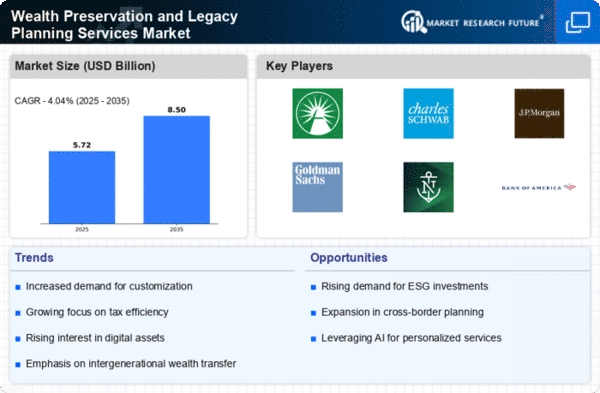

The competitive landscape is robust, with key players like Fidelity Investments, J.P. Morgan, and Goldman Sachs dominating the market. The U.S. remains the largest contributor, supported by a strong financial services sector and innovative wealth management solutions. As firms adapt to changing client needs, the focus on technology integration and sustainable investing is becoming increasingly prominent, ensuring continued growth in this sector.

Europe : Emerging Market with Growth Potential

Europe's Wealth Preservation and Legacy Planning Services Market is valued at 1.8B, reflecting a growing interest in wealth management solutions among affluent individuals. Factors such as an aging population and increasing cross-border wealth transfers are driving demand. Regulatory initiatives, including the EU's MiFID II, are enhancing transparency and investor protection, which are crucial for market growth and consumer trust.

Leading countries like Germany, the UK, and France are at the forefront, with a competitive landscape featuring firms such as UBS and Citi Private Client. The market is characterized by a mix of traditional banks and innovative fintech companies, creating a dynamic environment. As wealth management services evolve, firms are increasingly focusing on digital solutions to meet the diverse needs of clients, ensuring a competitive edge in this expanding market.

Asia-Pacific : Rapidly Growing Wealth Market

The Asia-Pacific region, with a market size of 0.9B, is witnessing rapid growth in Wealth Preservation and Legacy Planning Services. The rise of HNWIs, particularly in countries like China and India, is a key driver of this trend. Additionally, increasing awareness of estate planning and wealth transfer strategies is propelling demand. Regulatory bodies are also beginning to implement frameworks that support wealth management practices, enhancing market stability and growth prospects.

Countries such as Japan and Australia are leading the charge, with a competitive landscape that includes both local and international players. Firms are increasingly adopting technology-driven solutions to cater to the evolving preferences of clients. As the market matures, the focus on personalized services and sustainable investment options is expected to shape the future of wealth management in the region.

Middle East and Africa : Emerging Wealth Management Hub

The Middle East and Africa region, with a market size of 0.05B, is in the nascent stages of developing Wealth Preservation and Legacy Planning Services. Factors such as increasing wealth concentration and a growing number of HNWIs are beginning to drive demand for these services. Regulatory frameworks are gradually evolving to support wealth management practices, which is essential for attracting both local and foreign investments.

Countries like the UAE and South Africa are leading the market, with a competitive landscape that includes both established banks and emerging fintech firms. The region's unique cultural and economic dynamics present both challenges and opportunities for wealth management providers. As the market develops, there is a growing emphasis on tailored solutions that address the specific needs of clients, paving the way for future growth.