North America : Market Leader in Advisory Services

North America continues to lead the Real Estate Investment Advisory Services market, holding a significant share of 15.0 in 2025. The region's growth is driven by robust economic recovery, increased foreign investments, and favorable regulatory frameworks. Demand for commercial and residential properties is on the rise, supported by low interest rates and a growing population. The regulatory environment is conducive, with policies aimed at enhancing transparency and investor confidence.

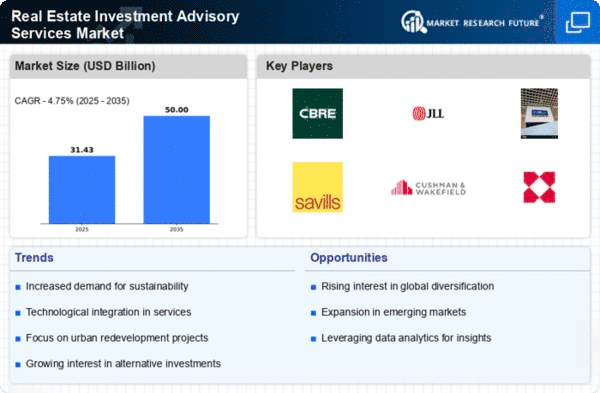

The competitive landscape is characterized by major players such as CBRE, JLL, and Cushman & Wakefield, which dominate the market. The U.S. remains the largest contributor, with cities like New York and Los Angeles attracting substantial investments. Canada also plays a vital role, with Colliers leading in advisory services. The presence of these key players ensures a dynamic market, fostering innovation and strategic partnerships.

Europe : Emerging Market with Growth Potential

Europe's Real Estate Investment Advisory Services market is poised for growth, with a market size of 8.0 in 2025. The region is experiencing a revitalization driven by post-pandemic recovery, increased urbanization, and a shift towards sustainable investments. Regulatory initiatives aimed at promoting green buildings and energy efficiency are catalyzing demand. Countries like Germany and France are leading the charge, supported by favorable investment climates and government incentives.

The competitive landscape features key players such as Savills and Knight Frank, which are expanding their services across the continent. The UK remains a significant market, with London being a hub for international investments. The presence of diverse investment opportunities, coupled with a strong regulatory framework, positions Europe as an attractive destination for real estate investments. "The European real estate market is adapting to new trends, focusing on sustainability and innovation," European Commission report, European Commission.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing a surge in the Real Estate Investment Advisory Services market, with a size of 5.0 in 2025. This growth is fueled by rapid urbanization, increasing disposable incomes, and a burgeoning middle class. Countries like China and India are at the forefront, with significant investments in infrastructure and real estate development. Regulatory reforms aimed at attracting foreign investments are further enhancing market dynamics.

The competitive landscape is evolving, with local and international players vying for market share. Key firms such as Colliers and JLL are expanding their footprint in the region, capitalizing on emerging opportunities. The presence of a diverse range of investment options, from commercial to residential properties, is attracting both domestic and foreign investors, making Asia-Pacific a hotspot for real estate advisory services.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is gradually emerging in the Real Estate Investment Advisory Services market, with a size of 2.0 in 2025. The growth is driven by urbanization, infrastructure development, and increasing foreign investments. Countries like the UAE and South Africa are leading the way, supported by government initiatives aimed at enhancing the real estate sector. Regulatory frameworks are evolving to attract more investments, creating a conducive environment for growth.

The competitive landscape is characterized by a mix of local and international players, with firms like Knight Frank and Cushman & Wakefield establishing a presence. The region offers diverse investment opportunities, particularly in commercial real estate, which is gaining traction. As the market matures, the potential for growth in advisory services is significant, making it an attractive area for investors. "The real estate sector in the Middle East is on the brink of transformation, driven by innovation and investment," Dubai Land Department report, Dubai Land Department.