North America : Market Leader in Education

North America leads the Personal Finance and Wealth Management Education Market, holding a significant share of 12.5 in 2024. The region's growth is driven by increasing financial literacy awareness, technological advancements, and a robust online education infrastructure. Regulatory support for educational initiatives further fuels demand, as institutions and platforms adapt to evolving consumer needs.

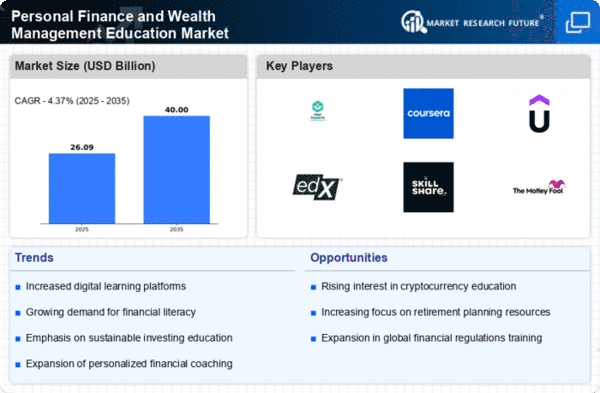

The competitive landscape is characterized by key players such as Khan Academy, Coursera, and Udemy, which dominate the online learning space. The presence of established financial education platforms like The Motley Fool and NerdWallet enhances the market's appeal. As more individuals seek to improve their financial knowledge, North America remains a pivotal hub for personal finance education, attracting investments and innovations.

Europe : Emerging Education Hub

Europe's Personal Finance and Wealth Management Education Market is valued at 7.5, reflecting a growing emphasis on financial literacy across the region. Factors such as increasing consumer debt and economic uncertainty drive demand for educational resources. Regulatory bodies are promoting financial education as a means to empower citizens, leading to a more informed populace.

Leading countries like the UK, Germany, and France are at the forefront of this movement, with numerous online platforms offering courses tailored to local needs. Key players include Coursera and edX, which provide diverse learning options. The competitive landscape is evolving, with traditional institutions partnering with online platforms to enhance accessibility and reach, ensuring that financial education becomes a priority across Europe.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 4.5, is witnessing a surge in demand for Personal Finance and Wealth Management Education. Factors such as rising disposable incomes, urbanization, and a growing middle class contribute to this trend. Governments are increasingly recognizing the importance of financial literacy, leading to initiatives aimed at integrating financial education into school curricula.

Countries like Australia, India, and Japan are leading the charge, with a mix of local and international players like Udemy and Skillshare entering the market. The competitive landscape is vibrant, with various platforms offering tailored courses to meet regional needs. As financial awareness grows, the Asia-Pacific market is poised for significant expansion, attracting investments and innovations in educational technologies.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region, with a market size of 0.5, is at the nascent stage of developing Personal Finance and Wealth Management Education. The growth is driven by increasing awareness of financial literacy and the need for better financial management among the population. Governments and NGOs are beginning to recognize the importance of financial education, leading to initiatives aimed at improving access to resources.

Countries like South Africa and the UAE are taking the lead, with local organizations and international platforms starting to offer financial education courses. The competitive landscape is still developing, but there is a growing interest from key players to invest in this market. As the region continues to evolve, the potential for growth in financial education is significant, paving the way for future advancements.