North America : Market Leader in Wealth Management

North America continues to lead the Financial Planning and Wealth Management Services market, holding a significant share of 172.5 million in 2024. The region's growth is driven by a robust economy, increasing disposable incomes, and a rising demand for personalized financial services. Regulatory support, including tax incentives and investment-friendly policies, further catalyzes market expansion. The trend towards digital financial solutions is also reshaping service delivery, enhancing customer engagement and satisfaction.

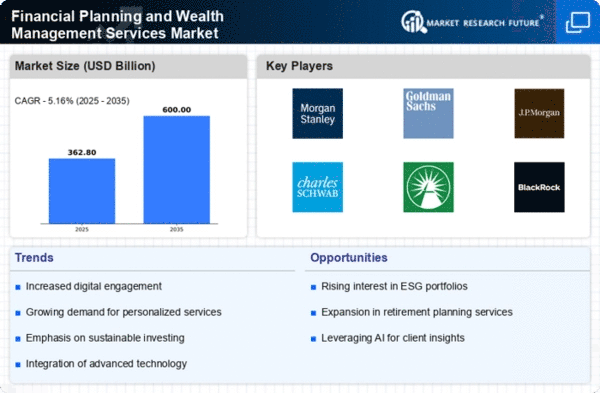

The competitive landscape is characterized by major players such as Morgan Stanley, Goldman Sachs, and J.P. Morgan, which dominate the market with innovative offerings and extensive client bases. The presence of these key players fosters a dynamic environment, encouraging competition and driving service quality. Additionally, the increasing focus on sustainable investing and wealth preservation strategies is shaping the services offered, catering to a diverse clientele seeking tailored financial solutions.

Europe : Emerging Wealth Management Hub

Europe's Financial Planning and Wealth Management Services market is projected to reach €90.0 million by 2025, driven by increasing wealth accumulation and a growing middle class. Regulatory frameworks, such as the MiFID II directive, enhance transparency and investor protection, fostering trust in financial services. The demand for sustainable investment options is also on the rise, reflecting a shift in consumer preferences towards ethical investing, which is expected to further boost market growth.

Leading countries in this region include the UK, Germany, and France, where established financial institutions like UBS Group and other local firms are expanding their service offerings. The competitive landscape is marked by a mix of traditional banks and fintech companies, creating a diverse ecosystem. This competition encourages innovation, particularly in digital wealth management solutions, catering to a tech-savvy clientele seeking efficient and accessible financial services.

Asia-Pacific : Rapidly Growing Financial Market

The Asia-Pacific region is witnessing significant growth in the Financial Planning and Wealth Management Services market, projected to reach $70.0 million by 2025. This growth is fueled by rising disposable incomes, urbanization, and an increasing number of high-net-worth individuals (HNWIs). Regulatory reforms aimed at enhancing financial literacy and investment opportunities are also contributing to market expansion, as governments encourage citizens to engage in wealth management practices.

Countries like China, India, and Australia are at the forefront of this growth, with a competitive landscape featuring both global players and local firms. Key players such as Fidelity Investments and BlackRock are expanding their presence, offering tailored services to meet the diverse needs of clients. The increasing adoption of digital platforms for wealth management is reshaping the industry, making services more accessible and efficient for a broader audience.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the Financial Planning and Wealth Management Services market, with a projected size of $12.5 million by 2025. The growth is driven by increasing wealth among individuals and a rising demand for sophisticated financial services. Regulatory initiatives aimed at enhancing financial stability and investor protection are also playing a crucial role in fostering market development, encouraging both local and foreign investments in the sector.

Leading countries in this region include the UAE and South Africa, where a mix of local banks and international firms are competing for market share. The presence of key players is growing, with firms focusing on personalized wealth management solutions to cater to the unique needs of affluent clients. The competitive landscape is evolving, with an increasing emphasis on digital transformation and innovative service delivery models to attract a diverse clientele.